Interest Calculation in Tally ERP9

Interest will be calculated on outstanding receivable or payable. Interest can be calculated on the basis of simple or compound interest in Tally.ERP9.

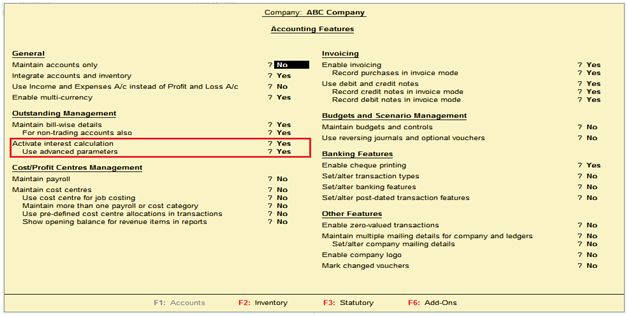

Enable Interest Calculations in Tally ERP9

Path: Gateway of Tally -> F11 Features -> Accounting Features

Activate Interest Calculation: Yes

Press enter to save the screen

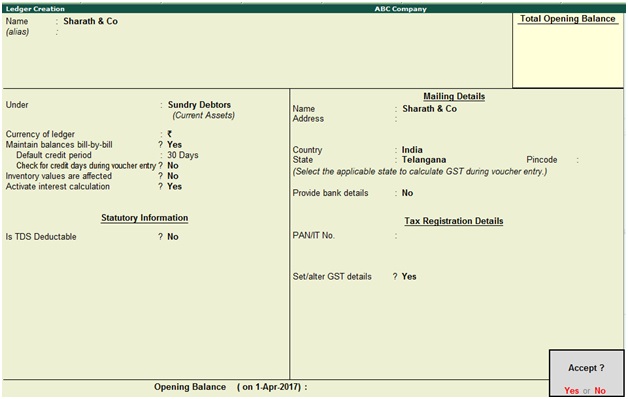

Create Party Ledger

Path: Gateway of Tally -> Accounts Info -> Ledgers -> Create

Name: Sharath & co

Under: Sundry Debtors

Default credit period: 30 days

Activate Interest Calculation: Yes, once activate this option then the below screen will appear

Press enter to save the screen

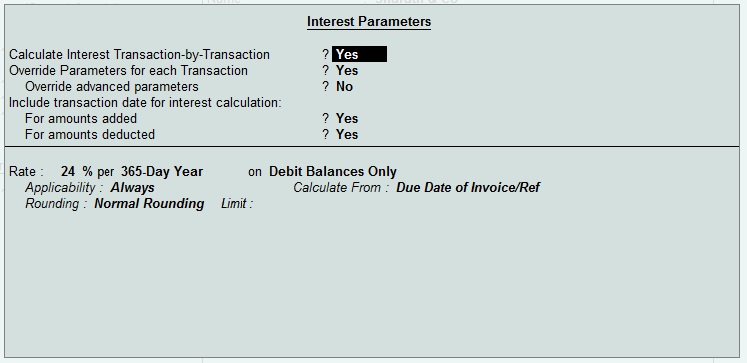

Calculate Interest Transaction-by-Transaction: Yes, Interest will calculate on each transaction.

Override Parameters for each Transaction: Yes, by activating this option you can able to change parameters i.e. rate of interest and interest style during the voucher.

Rate: Enter rate of interest

Per: There are four interest styles given by tally, select accordingly as per the requirement

- 30 day month

- 365 day Year

- Calendar Month

- Calendar Year

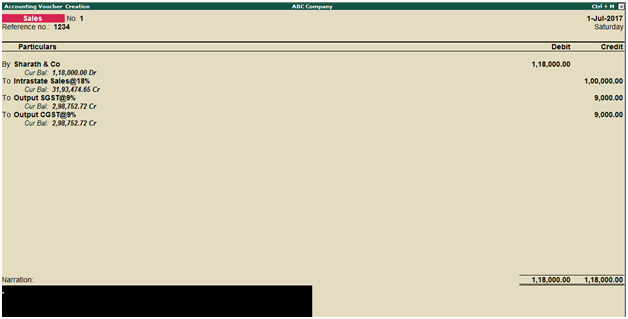

Recording of Sales Transaction in Tally ERP9

Path: Gateway of Tally -> Accounting vouchers -> F8 Sales (Voucher mode)

Debit the party account name and credit the sales and GST tax ledgers.

Press enter to save the screen

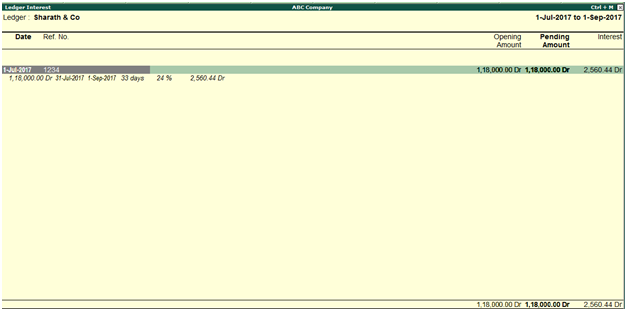

Check Simple Interest Calculations

Path: Gateway of Tally -> Display -> Statement of Accounts -> Interest Calculations -> Interest Receivable

To Record Interest in Books of Accounts

You can record the calculated interest in books of accounts by using debit note in Tally.ERP9.

Path: Gateway of Tally -> Accounting Vouchers -> Debit note

Debit the party account and credit the interest received account.

Press enter to save the screen

Related Topics

Cost Centre and Cost Category in Tally ERP9

Export Data from Tally to Excel or PDF

Related Pages

- How to Post TDS Receivable Entry in Tally ERP9

- List of Shortcut Keys in Tally ERP9

- Enable TDS in Tally ERP9

- GST Classifications in Tally ERP9

- Import of Goods under GST in Tally ERP9

- Sales to Unregistered Dealer in Tally ERP9

- Input Service Distributor under GST in Tally ERP9

- How to Activate GST in Tally ERP9

- How to Enable TDS in Tally ERP9

- TDS on Professional Charges in Tally ERP9

- GSTR-1 Report in Tally ERP9

- GSTR-2 Report in Tally ERP9

- GSTR-3B Report in Tally ERP9

- What is Tally ERP9

- How to Create Company in Tally ERP9

- List of Ledgers and Groups in Tally ERP9

- How to Create, Display, Alter and Delete Ledgers in Tally ERP9

- How to Create, Display, Alter and Delete Group in Tally ERP9

- Sales Voucher in Tally ERP9

- Purchase Voucher in Tally ERP9