TDS on Professional Charges in Tally ERP9

Once you have enabled TDS feature in Tally.ERP9 then you need to create necessary ledgers in Tally to record TDS related transactions.

Example

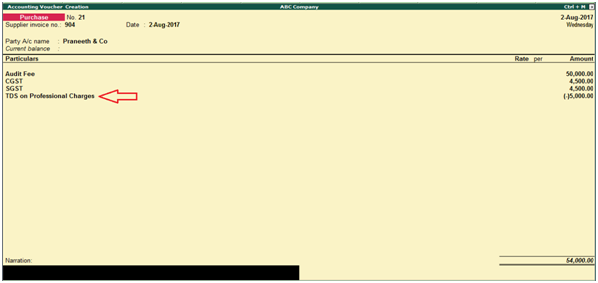

ABC company amount paid towards audit fee to Praneeth & Co of Rs.50,000 with GST@18%.

Entry

Audit Fee Dr 50,000

CGST Dr 4,500

SGST Dr 4,500

To TDS on Professional Charges 5,000

To Praneeth & Co 54,000

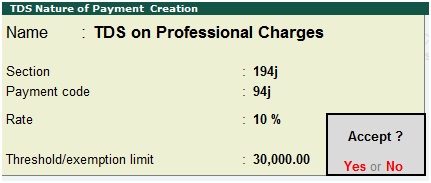

TDS Nature of Payment Creation

Path: Gateway of Tally -> Accounts info -> Statutory info -> TDS Nature of Payment -> Create

Name: TDS on Professional charges

Section: Enter section 194j

Payment code: 94j

Rate: 10%

Threshold/exemption limit: 30,000

Press enter to save the screen

The above TDS nature of payment has been created as per the section, payment code, rate and exemption limit.

Similarly you can create other nature of payments.

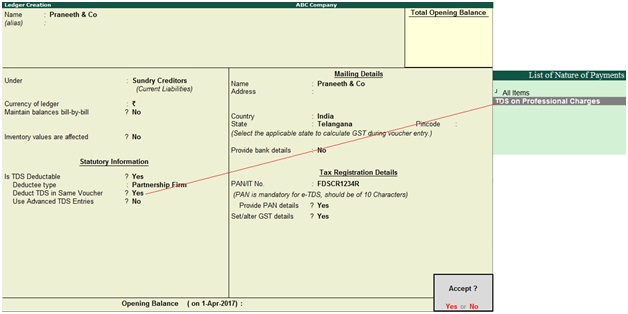

Vendor ledger Creation

Path: Gateway of Tally -> Accounts info -> Ledgers -> Create

Name: Praneeth & Co

Under: Sundry Creditors

Is TDS deductable: Yes

Deductee type: Select the deductee type as partnership firm

Deduct TDS in Same Voucher: Yes

Address: Enter vendor address

Country: Enter vendor country

State: Enter vendor state with Pin code

PAN/IT No: Enter PAN number of vendor

Provide PAN details: Yes

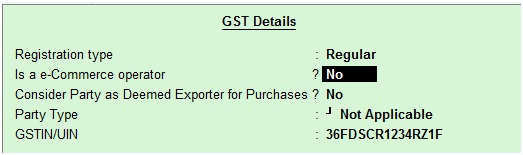

Set/alter GST details: Yes, once enable this option then the below GST details screen will appear.

Registration type: Select vendor registration type as regular (In case of Composition, Consumer and Unregistered then select accordingly)

GSTIN/UIN: Enter vendor GSTIN number

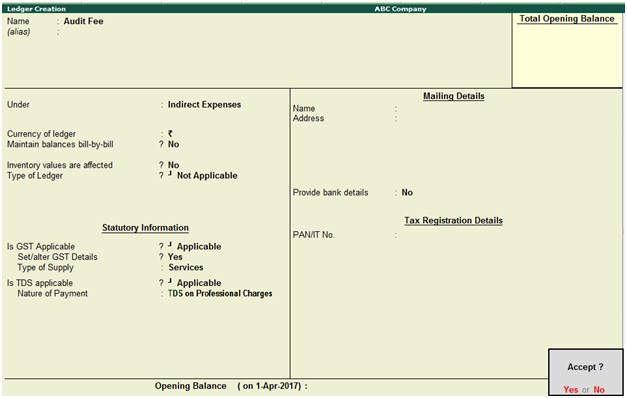

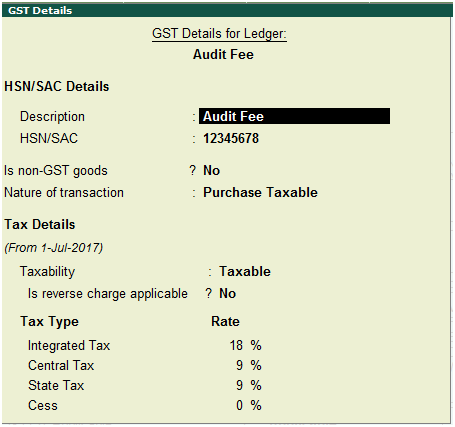

Expenses Ledger Creation

Path: Gateway of Tally -> Accounts info -> Ledgers -> Create

Name: Audit Fee

Under: Indirect Expenses

Is GST Applicable: Applicable

Set/alter GST details: Yes, once enable this option then the below GST details for ledger screen will appear.

Type of Supply: Services

Is TDS applicable: Applicable

Nature of Payment: TDS on Professional Charges

Press enter to save the screen

Nature of transaction: Purchase Taxable

Taxability: Taxable

GST Rate: 18%

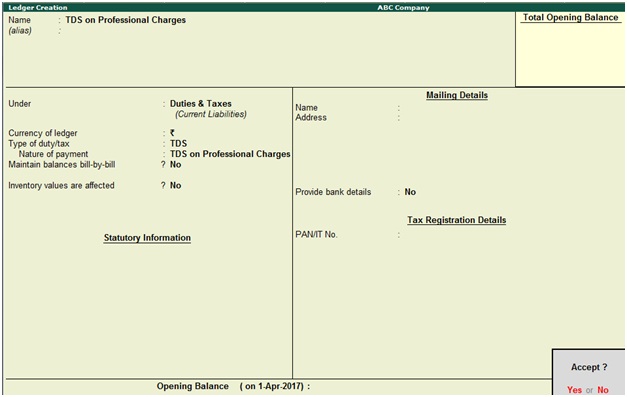

Ledger Creation: TDS on Professional Charges

Under: Duties & Taxes

Type of duty/tax: TDS

Nature of payment: TDS on Professional Charges

Press enter to save the screen

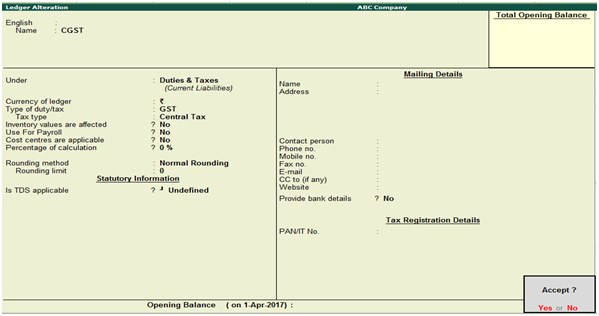

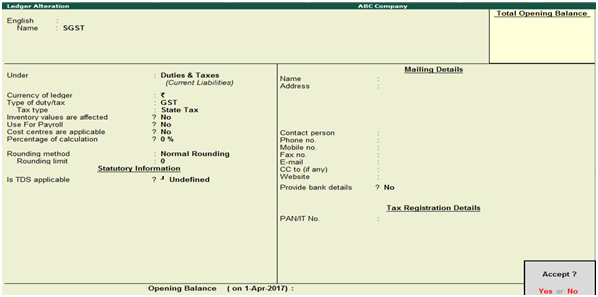

GST Ledgers Alteration

Path: Gateway of Tally -> Accounts info -> Ledgers -> Create

Name: CGST

Name: SGST

Recording of GST purchase invoice with TDS

Path: Gateway of Tally -> Accounting Vouchers -> F9 Purchases (Account invoice mode)

Press Enter to save the screen

To Check TDS Report Outstandings

Path: Gateway of Tally -> Display -> Statutory Reports -> TDS Reports -> TDS Outstandings

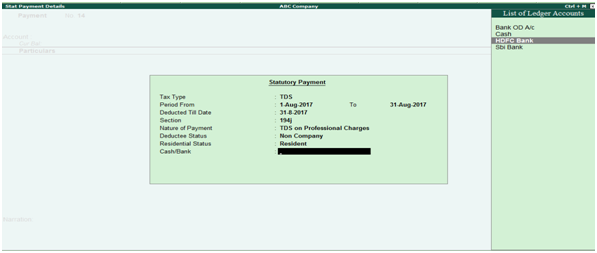

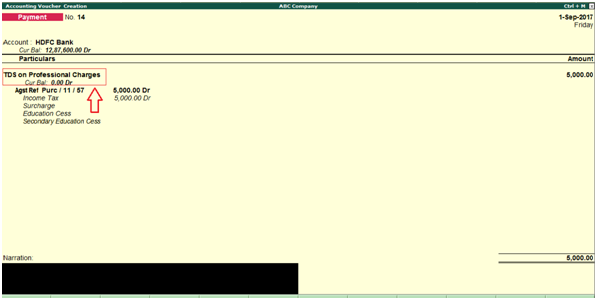

How to Record TDS Payment Entry

Path: Gateway of Tally -> Accounting Voucher-> F5 Payment

Click on Stat Payment

Tax Type: TDS

Period: 1.8.2017 to 31.08.2017

Deducted Till Date: 31.08.2017

Section: 194J

Nature of Payment: TDS on Professional Charges

Deductee Status: Non Company

Residential Status: Resident

Cash/Bank: Select Bank

Press enter

Press enter to save the screen

Related Topics

How to Enable TDS in Tally ERP9

TDS Rate Chart for Financial Year 2018-2019

Related Pages

- How to Post TDS Receivable Entry in Tally ERP9

- List of Shortcut Keys in Tally ERP9

- Enable TDS in Tally ERP9

- GST Classifications in Tally ERP9

- Import of Goods under GST in Tally ERP9

- Sales to Unregistered Dealer in Tally ERP9

- Input Service Distributor under GST in Tally ERP9

- How to Activate GST in Tally ERP9

- How to Enable TDS in Tally ERP9

- GSTR-1 Report in Tally ERP9

- GSTR-2 Report in Tally ERP9

- GSTR-3B Report in Tally ERP9

- What is Tally ERP9

- How to Create Company in Tally ERP9

- List of Ledgers and Groups in Tally ERP9

- How to Create, Display, Alter and Delete Ledgers in Tally ERP9

- How to Create, Display, Alter and Delete Group in Tally ERP9

- Sales Voucher in Tally ERP9

- Purchase Voucher in Tally ERP9

- Recording of GST Intrastate Sales in Tally ERP9