How to Enable TDS in Tally ERP9

Once you activate GST for your company then you can record different types of transactions in Tally.ERP9, such as local purchases, interstate purchases, nil rated, exempt, works contract and TDS related transactions.

How to enable Tax Deducted at Source (TDS) in Tally ERP9

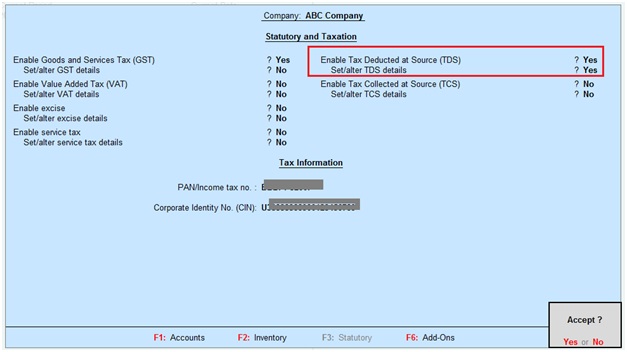

Path: Gateway of Tally -> F11 Features -> Statutory and Taxation

Enable Tax Deducted at Source (TDS): Yes

Set/alter TDS details: Yes, once enable this option then the below Company TDS Deductor details screen will appear.

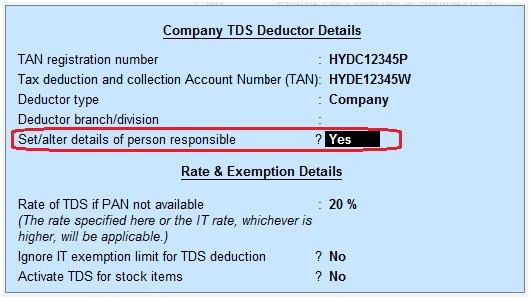

TAN registration number: Enter your company TAN number.

Tax Deduction and Collection Account Number (TAN): Enter Tax deduction and Collection Account number. This is a ten-digit alphanumeric number, issued by the Income Tax department to the deductors.

Deductor type: Select deductor type like, Company or Individual/HUF

Deductor branch/division: Enter deductor branch or division

Set/alter details of person responsible: Yes, once enable this option then the below screen will appear.

Rate of TDS if PAN not available: The higher rate of TDS will be applicable i.e. 20%, if the deductee does not have PAN.

Ignore IT exemption limit for TDS deduction: No. If you set this field to Yes, then it will ignore IT exemption.

If you set the above indicator to No, for example TDS exemption on Professional charges is Rs.30,000 per annum if exceeds this exemption limit then TDS should be calculated. If you set the above indicator to yes then it will ignore IT exemption limit and if you record professional charges is less than 30,000 per annum also TDS should be calculated.

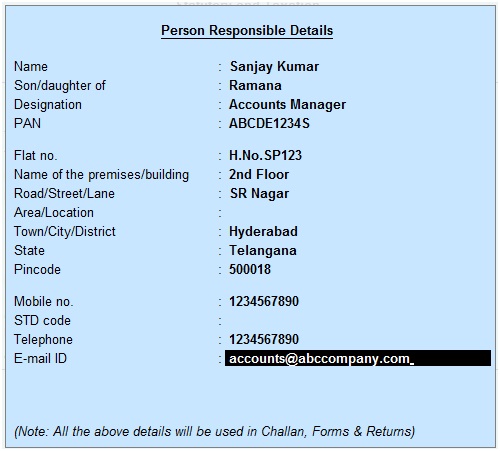

Set/alter details of person responsible

Enter person responsible details in the above screen to deduct the TDS.

Example for Deductor and Deductee

ABC company paid Audit fee to Praneeth & Co of Rs.50,000, here deductor is ABC company and deductee (The person whose payment has been deducted) is Praneeth & Co.

Related Topics

TDS on Professional Charges in Tally ERP9

TDS Rate Chart for Financial Year 2018-2019

Interest on Late Payment of TDS

Related Pages

- How to Post TDS Receivable Entry in Tally ERP9

- List of Shortcut Keys in Tally ERP9

- Enable TDS in Tally ERP9

- GST Classifications in Tally ERP9

- Import of Goods under GST in Tally ERP9

- Sales to Unregistered Dealer in Tally ERP9

- Input Service Distributor under GST in Tally ERP9

- How to Activate GST in Tally ERP9

- TDS on Professional Charges in Tally ERP9

- GSTR-1 Report in Tally ERP9

- GSTR-2 Report in Tally ERP9

- GSTR-3B Report in Tally ERP9

- What is Tally ERP9

- How to Create Company in Tally ERP9

- List of Ledgers and Groups in Tally ERP9

- How to Create, Display, Alter and Delete Ledgers in Tally ERP9

- How to Create, Display, Alter and Delete Group in Tally ERP9

- Sales Voucher in Tally ERP9

- Purchase Voucher in Tally ERP9

- Recording of GST Intrastate Sales in Tally ERP9