Interest on Late Payment of TDS

How to Calculate Interest on Late Payment of TDS

Interest will be calculated on the TDS amount in case if you have made late payment of TDS.

Example

X Company has to pay of Rs.1,00,000/-to the vendor towards professional service charges.

X Company has deducted TDS on 25th May 2016 of Rs.10,000 (10% on 1,00,000) and paid TDS on 10th June 2016.

In the above example X Company should pay TDS before 7th of June 2016 but paid on 10th June 2016.

While calculating interest on TDS, you have to consider May 2016 is one month and you have been delayed payment for 3 days from 8th June 2016 to 10th June then the X Company has to pay interest for 2 months i.e. May & June.

Interest rate on late payment of TDS is 1.5% per month (p.a.18%)

Total interest payable will be 3%

You need to calculate interest for 2 months on TDS amount of Rs.10,000

10,000*3/100 = 300

TDS payment entry

TDS on Professional charges 194J Dr 10,000

Interest on TDS (10,000*3%) Dr 300

To Bank 10,300

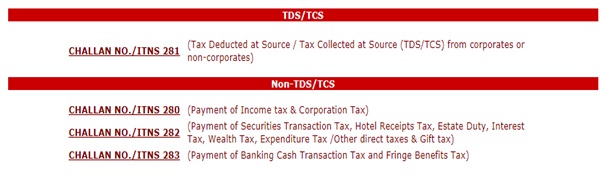

TDS is paid through Challan No. /ITNS 281

Payment of TDS

TDS should pay section wise, while making of payment you need to select financial year and section like 194C, 194J & 194H.

Visit the below link to pay TDS

https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp

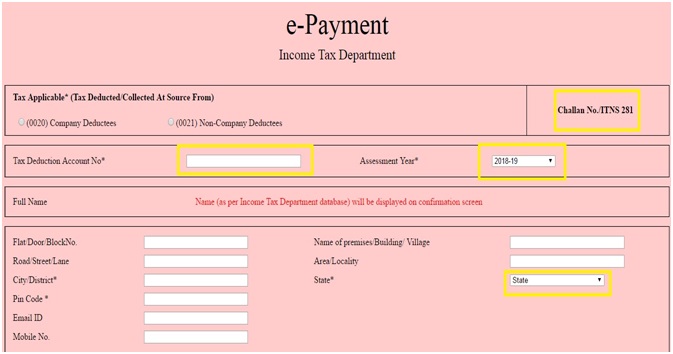

In the above screen shot click on Challan No./ITNS281 then the below e-payment page will appear

Based on type of deductee you have to select whether Company Deductees (In case of private limited companies) / Non Company deductees (In case of Individual)

Select assessment year

Tax deduction account number – Once you enter TAN number in this filed your company information will display automatically.

Enter your company address

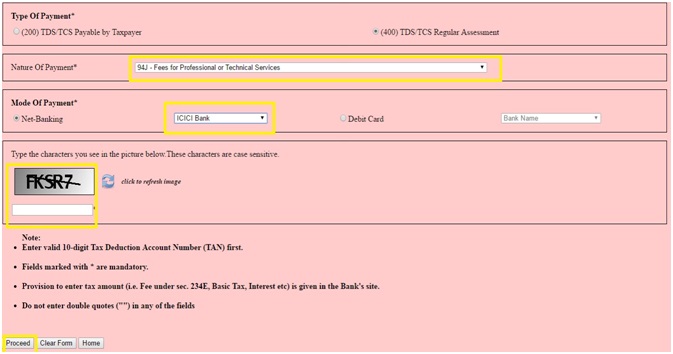

In the above screen shot you have to select the following fields

TDS/TCS Regular Assessment

Nature of Payment (194j, 194H & 194C)

Net Banking / Debit Card

Click on Proceed to pay TDS

Related Pages

- 6 Reasons Why You Have Not Received Your Income Tax Refund Yet

- TDS on Rent Section 194I

- GST Accounting Entries for Sales and Purchases

- How to Make TDS Payment Online?

- Journal Entries For TDS

- Claiming of Tuition Fees Under Section 80C

- TCS Rates Chart

- TDS Rate Chart for Financial Year 2018-2019

- Income Tax Slab Rates FY 2018-2019

- What is GST?

- GST

- GST Registration

- GST Invoice

- GST Return

- Income Tax Slab Rates FY 2017-2018

- Professional Tax

- TDS Rate Chart for FY 2017-2018

- TDS Refund

- Gratuity Calculation

- House Rent Allowance Calculation