How to Make TDS Payment Online?

The payee is required to deduct TDS while making of certain payments like, rent, commission, interest, and professional charges etc.

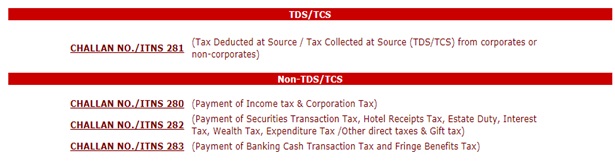

Visit the below link to pay TDS

https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp

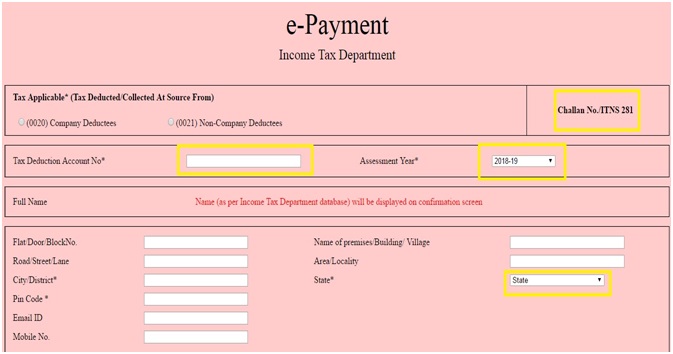

Click on Challan No./ITNS281 then the below e-Payment screen will appear.

Tax Applicable: Select company deductees or non-company deductees based on deductee.

Example, You have deducted TDS for company deductees and non-company deductees, in this case you have to pay separately for company deductees and non-company deductees.

Assessment Year: Select assessment year

Tax Deduction Account No: Enter company tax deduction account number. If your company TAN number is valid then the full name of company will display automatically.

Enter company address

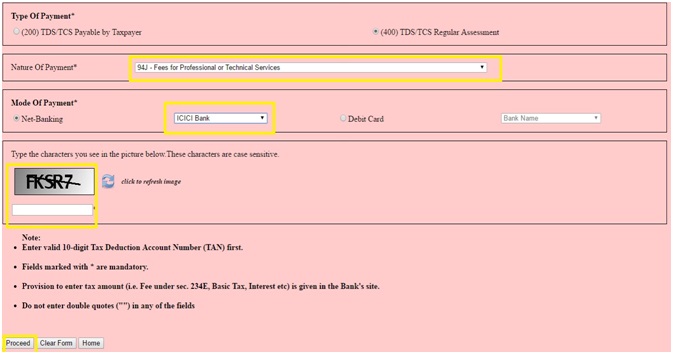

Type of Payment: Select TDS/TCS regular assessment

Nature of Payment: Select TDS nature of payment example, 94J fees for professional or technical services ( click on drop down to see different nature of payments)

Mode of Payment: Select Net Banking / Debit Card

Enter the characters as shown in the above screen

Click on Proceed to pay TDS

The tax payer has to login net banking and need to enter user id and password of bank and make the TDS payment.

After successful payment of TDS a challan will be displayed. The challan contains the below fields.

Company TAN number

Received from – Your company name

CIN details like, BSR code, payment date and challan number

Nature of payment details like, 94J fees for professional or technical services

Assessment year

Related Pages

- 6 Reasons Why You Have Not Received Your Income Tax Refund Yet

- TDS on Rent Section 194I

- GST Accounting Entries for Sales and Purchases

- Journal Entries For TDS

- Claiming of Tuition Fees Under Section 80C

- TCS Rates Chart

- TDS Rate Chart for Financial Year 2018-2019

- Income Tax Slab Rates FY 2018-2019

- What is GST?

- GST

- GST Registration

- GST Invoice

- GST Return

- Income Tax Slab Rates FY 2017-2018

- Professional Tax

- TDS Rate Chart for FY 2017-2018

- Interest on Late Payment of TDS

- TDS Refund

- Gratuity Calculation

- House Rent Allowance Calculation