6 Reasons Why You Have Not Received Your Income Tax Refund Yet

Income tax refund will be issued by the department of income tax subject to when your tax paid is higher than tax liability.

There are few reasons why you haven’t received your income tax refund

- After filing your income tax return you have to send signed ITR-V copy to Bangalore CPC or you have to do E-verification through net banking.

- The income tax department takes time to process your refund and make sure that you would have sent your ITR-V within 120 days from the date of e-filing.

- The communication address updated by you is incorrect. You need to update your current communication address to receive refund cheque from the income tax department.

- Sometimes your refund was failed due to incorrect bank details updated by you, hence you should update your bank account details correctly such as bank IFSC code, bank name and account number while filing of return.

- Sometimes you may forget to include some deductions while filing income tax return, which will leads to no refund for the financial year.

- The IT department will ask you additional information or supporting documents to process your refund.

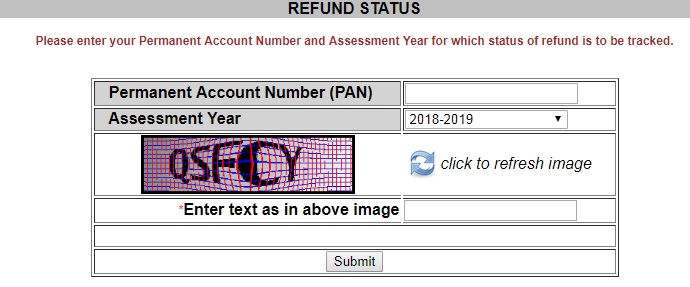

Check income tax refund status online

Visit this website

Enter permanent account number (PAN)

Click on drop down and select assessment year

Enter captcha code as shown in the image

Click on submit

Related Pages

- TDS on Rent Section 194I

- GST Accounting Entries for Sales and Purchases

- How to Make TDS Payment Online?

- Journal Entries For TDS

- Claiming of Tuition Fees Under Section 80C

- TCS Rates Chart

- TDS Rate Chart for Financial Year 2018-2019

- Income Tax Slab Rates FY 2018-2019

- What is GST?

- GST

- GST Registration

- GST Invoice

- GST Return

- Income Tax Slab Rates FY 2017-2018

- Professional Tax

- TDS Rate Chart for FY 2017-2018

- Interest on Late Payment of TDS

- TDS Refund

- Gratuity Calculation

- House Rent Allowance Calculation