House Rent Allowance Calculation

House rent allowance provided by an employer to his employee and it is part of the salary. The HRA exemption should be claimed if an employee is residing in a rented house. HRA is one of the important tax savings benefits for the employee.

HRA will be calculated based on employee basic salary, if an employee residence in metro city, then HRA will be 50% of his basic salary and if other than metro city residence then HRA will be 40%.

House rent allowance is relevant to only salaried employees who are staying in rental accommodation.

HRA Calculation

The minimum of the following options

1.The actual HRA received from employer

2.Actual rent paid less 10% of basic salary

3.40% of basic salary, in case if an employee is lives in non metro city

Example

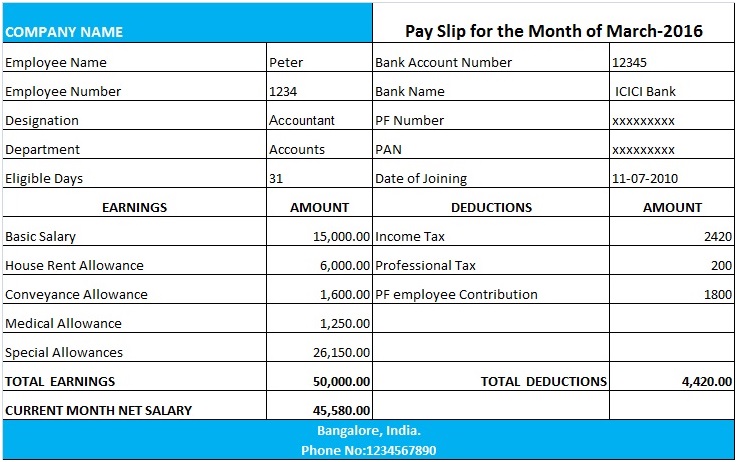

Mr. Peter stays in non metro city and his monthly salary is Rs.50,000/- and his basic salary as per their company policy is 15,000/-.

1.The actual HRA received from employer = 6,000 (15000*40% = 6,000 yearly 6000*12=72,000)

2.Actual rent paid less 10% of basic salary = 8,000 (Yearly 8,000*12=96,000 – 18,000 (10% on basic i.e. 15000*10% = 1500 and yearly 1500*12 = 78,000)

3.40% on basic salary, in case if an employee is staying in non metro city = 72,000 (15000*40%)*12 Months

HRA exemption under section 10 (13A) of Income tax is Rs.72,000/-

If an employee paying rent more than 1,00,000/- per annum, then he should provide landlord’s PAN number.

The landlord needs to provide a self declaration if he doesn’t have Permanent Account Number (PAN).

Sample Pay Slip

Related Pages

- 6 Reasons Why You Have Not Received Your Income Tax Refund Yet

- TDS on Rent Section 194I

- GST Accounting Entries for Sales and Purchases

- How to Make TDS Payment Online?

- Journal Entries For TDS

- Claiming of Tuition Fees Under Section 80C

- TCS Rates Chart

- TDS Rate Chart for Financial Year 2018-2019

- Income Tax Slab Rates FY 2018-2019

- What is GST?

- GST

- GST Registration

- GST Invoice

- GST Return

- Income Tax Slab Rates FY 2017-2018

- Professional Tax

- TDS Rate Chart for FY 2017-2018

- Interest on Late Payment of TDS

- TDS Refund

- Gratuity Calculation