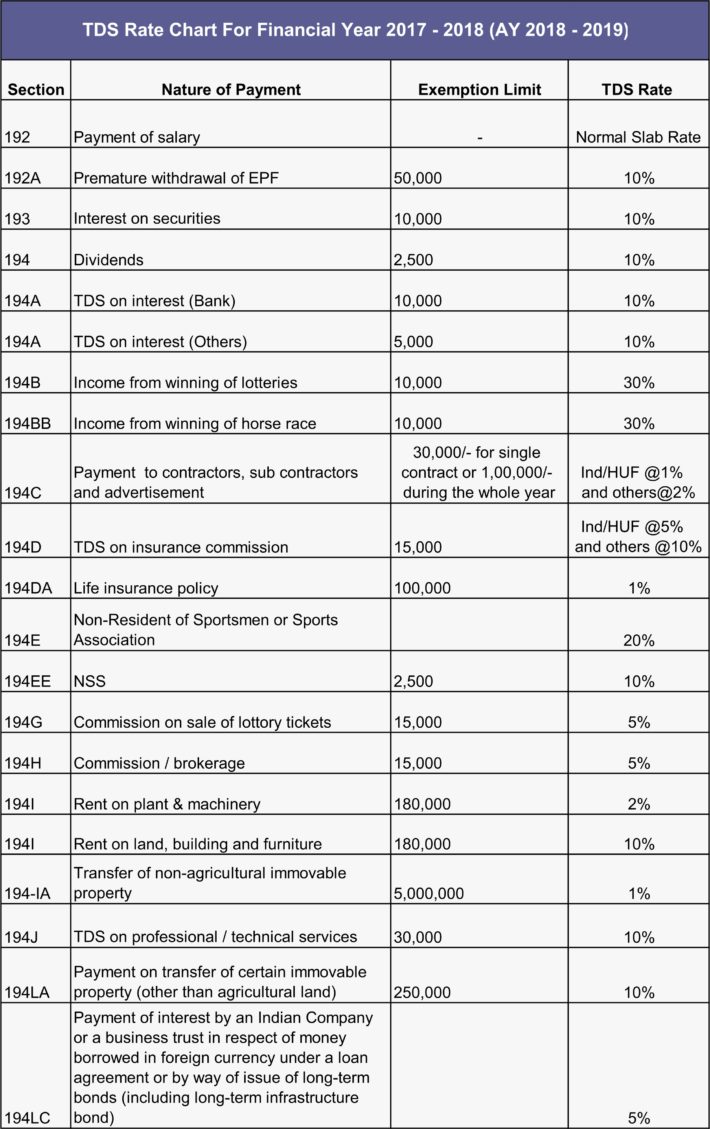

TDS Rate Chart for FY 2017-2018

TDS Rate Chart for FY 2017-2018 (AY 2018-2019)

- Due date for payment of TDS is 7th of following month except March is 30th April

- Higher rate of TDS will attract incase of not furnishing of PAN@20%

- Education cess and Surcharge will not attract except TDS on Salary payment

- Rs.200/- per day will attract for Late filling of TDS return

- Interest will applicable per month@1.5% (Per Annum 18%) in case late payment of TDS

- Deductor should issue Form 16 or 16A to their vendors (Form 16 for Salaries and Form 16A for other than salaries) after completion of financial year.

eTDS Filling due dates

First quarter from 1st April to 30th June due date is 31st July of Financial Year

Second quarter from 1st July to 30th September due date is 31st October of Financial Year

Third quarter from 1st October to 31st December due date is 31st January of Financial Year

Fourth quarter from 1st January to 31st March due date is 31st May of following Financial Year

Related Pages

- 6 Reasons Why You Have Not Received Your Income Tax Refund Yet

- TDS on Rent Section 194I

- GST Accounting Entries for Sales and Purchases

- How to Make TDS Payment Online?

- Journal Entries For TDS

- Claiming of Tuition Fees Under Section 80C

- TCS Rates Chart

- TDS Rate Chart for Financial Year 2018-2019

- Income Tax Slab Rates FY 2018-2019

- What is GST?

- GST

- GST Registration

- GST Invoice

- GST Return

- Income Tax Slab Rates FY 2017-2018

- Professional Tax

- Interest on Late Payment of TDS

- TDS Refund

- Gratuity Calculation

- House Rent Allowance Calculation