Gratuity Calculation

What is Gratuity?

Gratuity is an employee benefit under the payment of Gratuity Act 1972.

Gratuity is a kind of retirement benefit to the employees in India and the same paid by an employer to their employees who have been completed 5 years or more years with the company.

The following cases Gratuity is payable to an employee as per payment of Gratuity Act 1972

•If an employee retires

•If an employee left the organisation after completion of 5 years

•Passes away

Important points

In case if an employee has been terminated from the services due to any reasons, the employer has the right to reject payment of Gratuity to the employee.

In case of death of an employee the Gratuity will be paid to the nominee.

Calculation of Gratuity

Gratuity will be calculated based on number of years worked with an employer and last drawn salary of employee.

Gratuity = [(Basic + DA) * 15 days * No of years service] /26

15 /26 indicates 15 days out of 26 working days in a month

Last drawn salary is Basic + DA

Number of years service: Example an employee worked with the organisation 10 years, here you have to calculate gratuity for 10 years.

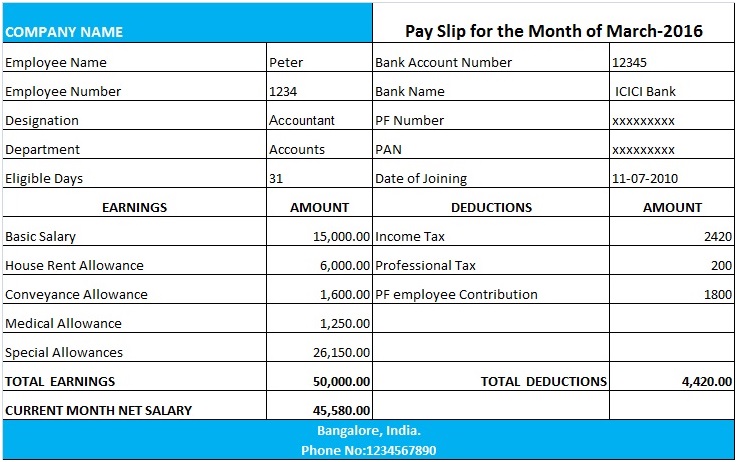

Example

Peter is an accountant who has worked with X company for ten years and his last drawn basic pay is Rs.15,000 and Dearness Allowance is Rs.1000.

= [(15000+1000) *15*10]/26

= (16,000*150)/26

= 24,00,000/26

Total = 92,308/-

Sample Pay Slip

Related Pages

- 6 Reasons Why You Have Not Received Your Income Tax Refund Yet

- TDS on Rent Section 194I

- GST Accounting Entries for Sales and Purchases

- How to Make TDS Payment Online?

- Journal Entries For TDS

- Claiming of Tuition Fees Under Section 80C

- TCS Rates Chart

- TDS Rate Chart for Financial Year 2018-2019

- Income Tax Slab Rates FY 2018-2019

- What is GST?

- GST

- GST Registration

- GST Invoice

- GST Return

- Income Tax Slab Rates FY 2017-2018

- Professional Tax

- TDS Rate Chart for FY 2017-2018

- Interest on Late Payment of TDS

- TDS Refund

- House Rent Allowance Calculation