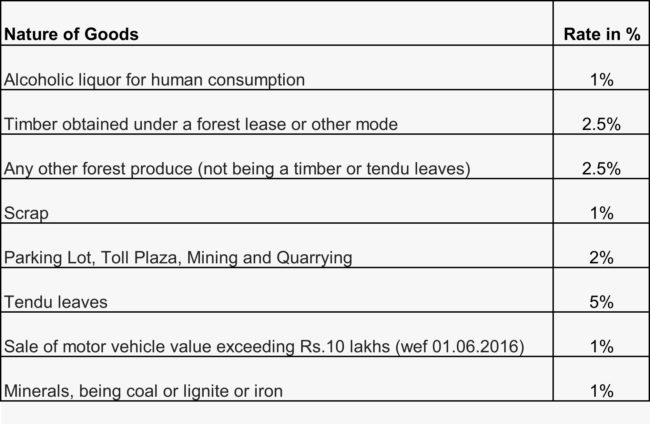

TCS Rates Chart

What is TCS?

The full form of TCS is Tax Collect at Source. Tax collected by the seller from buyer on specific goods specified in section 206C of Income Tax Act, 1961. The seller will collect and deposit the tax to the Government.

TCS Rates in India

Note: TCS Rates without PAN – Double of TCS rate or 5%, whichever is higher

Example for TCS

Sold 2000 MT scrap to Balu Traders each MT@50, and collected tax (TCS) on Rs.1,00,000.

Balu Traders Dr – 1,19,180

To Scrap – 1,00,000

To Output CGST@9% – 9,000

To Output SGST@9% – 9,000

To TCS on Scrap – 1,180

Related Topics

Income Tax Slab Rates FY 2018-2019

TDS Rate Chart for Financial Year 2018-2019

Related Pages

- 6 Reasons Why You Have Not Received Your Income Tax Refund Yet

- TDS on Rent Section 194I

- GST Accounting Entries for Sales and Purchases

- How to Make TDS Payment Online?

- Journal Entries For TDS

- Claiming of Tuition Fees Under Section 80C

- TDS Rate Chart for Financial Year 2018-2019

- Income Tax Slab Rates FY 2018-2019

- What is GST?

- GST

- GST Registration

- GST Invoice

- GST Return

- Income Tax Slab Rates FY 2017-2018

- Professional Tax

- TDS Rate Chart for FY 2017-2018

- Interest on Late Payment of TDS

- TDS Refund

- Gratuity Calculation

- House Rent Allowance Calculation