How to Post TDS Receivable Entry in Tally ERP9

When you have raised service invoice to your client, on which your client/customer requires to deduct TDS based on the nature of transaction, such as professional service charges, rent on plant and machinery, contracts and advertisement etc.

Customer will pay invoice due amount after deduction of TDS from the receivable amount.

Customer is liable to pay deducted TDS amount to the Income Tax department before the due date. Hence for the deducted TDS amount you will receive form 16A from your customer, the same you can claim against provision for Income Tax.

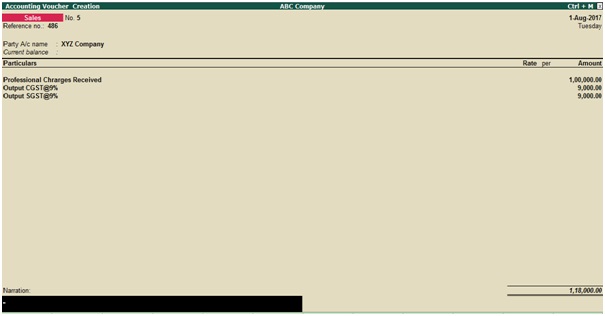

Service Invoice Entry

XYZ Company Dr 1,18,000

To Technical service charges received 1,00,000

To CGST@9% 9,000

To SGST@9% 9,000

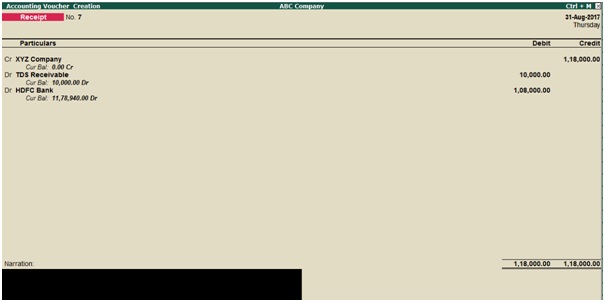

Payment From Customer

Bank Dr 1,08,000

TDS Receivable Dr 10,000

To XYZ Company 1,18,000

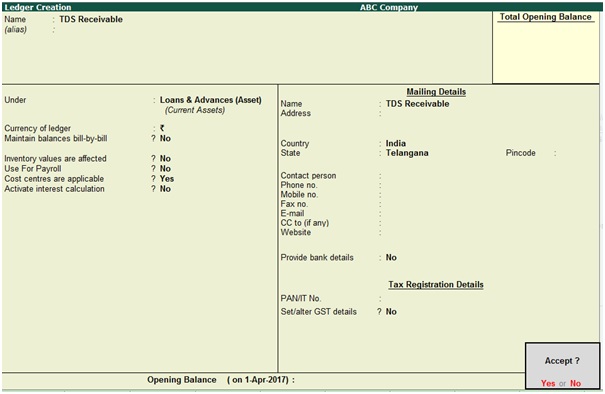

Create TDS Receivable Ledger in Tally.ERP9

Path: Gateway of Tally -> Accounts info -> Ledgers -> Create

Name: TDS Receivable

Under: Loans & Advances (Asset)

Press enter to save the screen

Recording of Sales Invoice in Tally.ERP9

Path: Gateway of Tally -> Accounting Vouchers -> Sales Voucher (F8)

Press enter to save the screen

Recording of Payment Receipt Entry From Customer

Credit XYZ Company and give debit to TDS receivable and Bank account.

Press enter to save the screen

Related Pages

- List of Shortcut Keys in Tally ERP9

- Enable TDS in Tally ERP9

- GST Classifications in Tally ERP9

- Import of Goods under GST in Tally ERP9

- Sales to Unregistered Dealer in Tally ERP9

- Input Service Distributor under GST in Tally ERP9

- How to Activate GST in Tally ERP9

- How to Enable TDS in Tally ERP9

- TDS on Professional Charges in Tally ERP9

- GSTR-1 Report in Tally ERP9

- GSTR-2 Report in Tally ERP9

- GSTR-3B Report in Tally ERP9

- What is Tally ERP9

- How to Create Company in Tally ERP9

- List of Ledgers and Groups in Tally ERP9

- How to Create, Display, Alter and Delete Ledgers in Tally ERP9

- How to Create, Display, Alter and Delete Group in Tally ERP9

- Sales Voucher in Tally ERP9

- Purchase Voucher in Tally ERP9

- Recording of GST Intrastate Sales in Tally ERP9