How to Activate GST in Tally ERP9

You have to enable GST features in Tally.ERP9 to record GST related transactions. After activation of GST for your company, then all GST related features are available for ledgers, stock items, transactions and you can generate GST returns as well.

Step 1

Open a company in Tally.ERP9 for which company you want to enable GST features.

Step 2

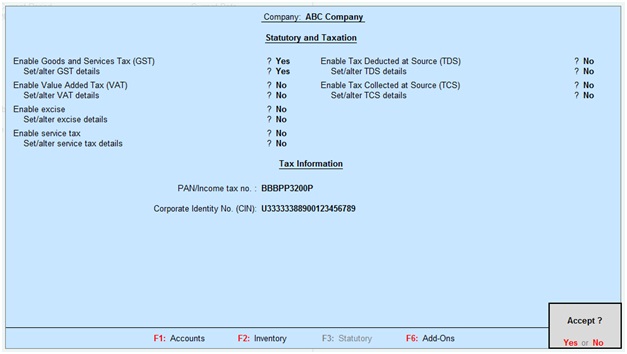

Click on F11 Features from Gateway of Tally screen and click on Statutory & Taxation.

Enable Goods and Service Tax (GST): Yes

Set/Alter GST details: Yes, once enable this option then the below screen will appear

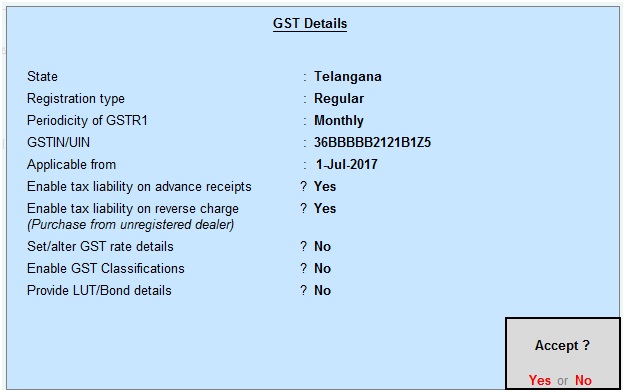

Registration type: Regular

GSTIN/UIN: You have to specify your company GSTIN number and this will appear on invoices and reports.

Applicable from: By default it will display GST applicable from 1st July 2017

Enable tax liability on advance receipts: Activate “Yes” to calculate tax liability on advance receipt.

Enable tax liability on reverse charge: Activate “Yes” to calculate tax liability for reverse charge on URD purchases.

Click on Yes to accept and save the entry

Related Topics

Create GST Tax Ledgers in Tally ERP9

Creation of Purchase Ledgers for GST in Tally ERP9

Creation of Stock Items for GST in Tally ERP9

Related Pages

- How to Post TDS Receivable Entry in Tally ERP9

- List of Shortcut Keys in Tally ERP9

- Enable TDS in Tally ERP9

- GST Classifications in Tally ERP9

- Import of Goods under GST in Tally ERP9

- Sales to Unregistered Dealer in Tally ERP9

- Input Service Distributor under GST in Tally ERP9

- How to Enable TDS in Tally ERP9

- TDS on Professional Charges in Tally ERP9

- GSTR-1 Report in Tally ERP9

- GSTR-2 Report in Tally ERP9

- GSTR-3B Report in Tally ERP9

- What is Tally ERP9

- How to Create Company in Tally ERP9

- List of Ledgers and Groups in Tally ERP9

- How to Create, Display, Alter and Delete Ledgers in Tally ERP9

- How to Create, Display, Alter and Delete Group in Tally ERP9

- Sales Voucher in Tally ERP9

- Purchase Voucher in Tally ERP9

- Recording of GST Intrastate Sales in Tally ERP9