Input Service Distributor under GST in Tally ERP9

When multiple services have been received for operating of business under a single registration, against a single tax invoice, the tax credit of such services can be distributed among the each business as input service distributor credit.

You can record a journal voucher to avail the ISD credit.

Example

ABC Company located in Bangalore, Karnataka. They also have unit located in Hyderabad (Telangana State) and Mumbai.

The unit in Bangalore is the head office and registered under ISD. ABC Company will do bulk procurement of common services which are used by the other units also.

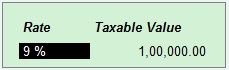

ABC company (HO) receives an invoice of Rs.1,00,000 with GST of Rs.18,000 (CGST Rs.9000 and SGST Rs.9000) towards advertisement services provided to the Hyderabad unit only.

Recording a journal voucher for input service distributor (ISD) credit under GST

Path: Gateway of Tally -> Accounting vouchers -> F7 Journal

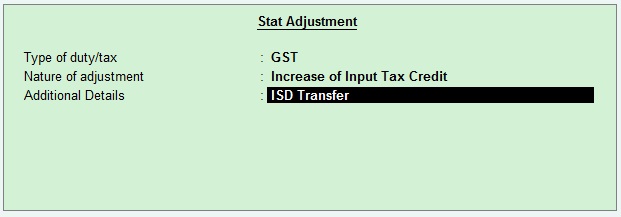

Click on J: Stat Adjustment

Select options in stat adjustment details screen as shown below

Type of duty/tax: GST

Nature of Adjustment: Increase of Input Tax Credit

Additional Details: ISD transfer

Press enter to save the screen

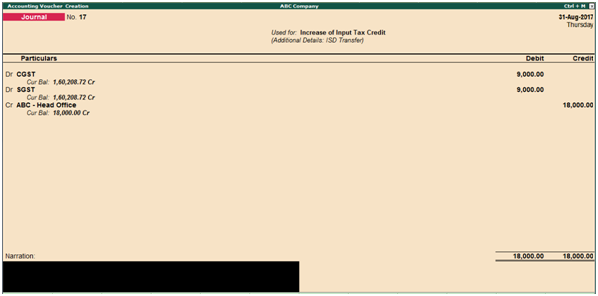

Journal entry

Debit the state tax, central tax, integrated tax or cess ledgers and credit the party ledger account.

Press enter to save the screen

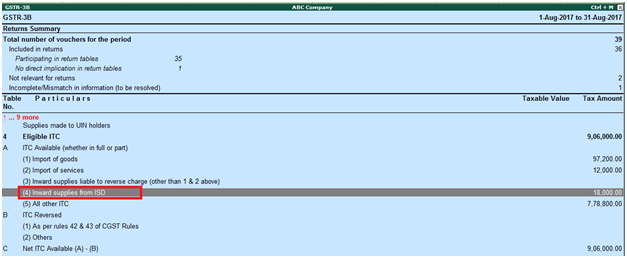

Check GSTR-3B Report

Path: Gateway of Tally -> Display -> Statutory Report -> GST -> GSTR-3B

Related Topics

Adjustments Against Tax Credit under GST in Tally ERP9

Debit Note and Credit Note in Tally ERP9

GST Classifications in Tally ERP9

Related Pages

- How to Post TDS Receivable Entry in Tally ERP9

- List of Shortcut Keys in Tally ERP9

- Enable TDS in Tally ERP9

- GST Classifications in Tally ERP9

- Import of Goods under GST in Tally ERP9

- Sales to Unregistered Dealer in Tally ERP9

- How to Activate GST in Tally ERP9

- How to Enable TDS in Tally ERP9

- TDS on Professional Charges in Tally ERP9

- GSTR-1 Report in Tally ERP9

- GSTR-2 Report in Tally ERP9

- GSTR-3B Report in Tally ERP9

- What is Tally ERP9

- How to Create Company in Tally ERP9

- List of Ledgers and Groups in Tally ERP9

- How to Create, Display, Alter and Delete Ledgers in Tally ERP9

- How to Create, Display, Alter and Delete Group in Tally ERP9

- Sales Voucher in Tally ERP9

- Purchase Voucher in Tally ERP9

- Recording of GST Intrastate Sales in Tally ERP9