Debit Note and Credit Note in Tally ERP9

In simple words about Debit and Credit notes, when there are purchase returns and sales returns in any business, debit note used for purchase returns and credit note used sales returns.

Example, ABC Company sold goods worth of Rs.50,000 to XYZ Company, After checking the goods, XYZ company has returned damaged goods worth of Rs.20,000 to ABC company. Here XYZ Company issue debit note to ABC Company.

Debit Note in Tally ERP9

This note will use for purchase returns, it is issued by a buyer to a seller debiting to his account and requesting for credit note.

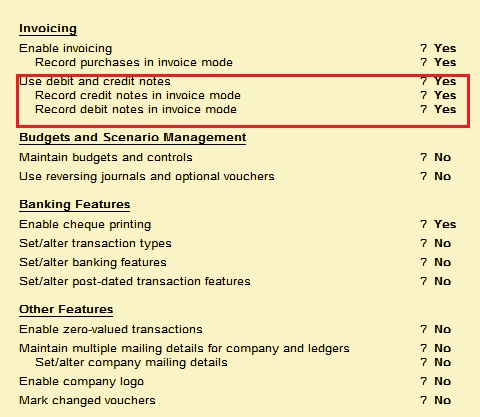

How to Activate Debit Note and Credit Note in Tally ERP9

Path: Gateway of Tally -> F11 Features -> Accounting Features

Use debit and credit notes: Yes

Example

ABC Company has purchased 6 HP Computers from Ram Enterprises worth of each is Rs. 45,000 with GST@18% (CGST@9% and SGST@9%).

Entry

HP Computers Dr 2,70,00

CGST Dr 24,300

SGST Dr 24,300

To Ram Enterprises 3,18,600

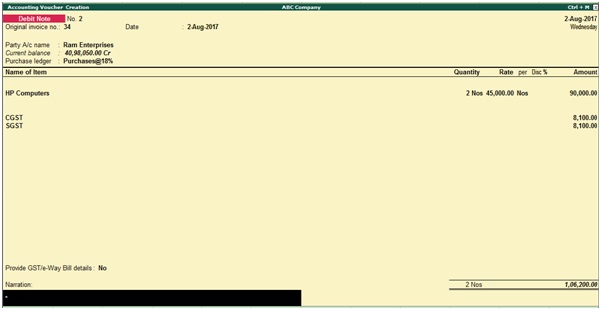

ABC Company has returned damaged 3 Dell Computers to Ram Enterprises, here you should post the below debit note entry in Tally debiting to supplier A/c and crediting to HP Computers.

Debit Note Entry in Tally ERP9

Ram Enterprises Dr 1,06,200

To HP Computers 90,000

To CGST 8,100

To SGST 8,100

Credit Note in Tally ERP9

This note will use for sales returns, it is issued by a seller to buyer in different situations informing that his account is credited.

Example: ABC Company has sold 8 Dell computers to Rajesh & Co each@ Rs.55,000 with GST@18% (CGST@9% and SGST@9%).

Entry

Rajesh & Co Dr 5,19,200

To Dell Computers 4,40,000

To CGST 39,600

To SGST 39,600

Rajesh & Co has returned 2 damaged Dell Computers to ABC Company, here you should record the below credit note entry.

Credit Note Entry in Tally ERP9

Dell Computers Dr 1,65,000

CGST Dr 14,850

SGST Dr 14,850

To Rajesh & Co 1,94,700

Related Topics

Recording of GST Intrastate Sales in Tally ERP9

Recording of GST Local Purchases in Tally ERP9

Related Pages

- How to Post TDS Receivable Entry in Tally ERP9

- List of Shortcut Keys in Tally ERP9

- Enable TDS in Tally ERP9

- GST Classifications in Tally ERP9

- Import of Goods under GST in Tally ERP9

- Sales to Unregistered Dealer in Tally ERP9

- Input Service Distributor under GST in Tally ERP9

- How to Activate GST in Tally ERP9

- How to Enable TDS in Tally ERP9

- TDS on Professional Charges in Tally ERP9

- GSTR-1 Report in Tally ERP9

- GSTR-2 Report in Tally ERP9

- GSTR-3B Report in Tally ERP9

- What is Tally ERP9

- How to Create Company in Tally ERP9

- List of Ledgers and Groups in Tally ERP9

- How to Create, Display, Alter and Delete Ledgers in Tally ERP9

- How to Create, Display, Alter and Delete Group in Tally ERP9

- Sales Voucher in Tally ERP9

- Purchase Voucher in Tally ERP9