GSTR-1 Report in Tally ERP9

GSTR-1 is a monthly or quarterly return, every registered dealer under GST has to file return. It contains outward supplies (Sales).

The due dates for GSTR-1 is based on your company turnover, the following are the due dates until June 2018.

Business turnover up to 1.5 crores then you have to file quarterly return

Business turnover above 1.5 crores then you have to file monthly return

GSTR-1 Report in Tally.ERP9

Every registered dealer under GST has to file monthly GSTR1 return and it includes outward supplies for the particular period.

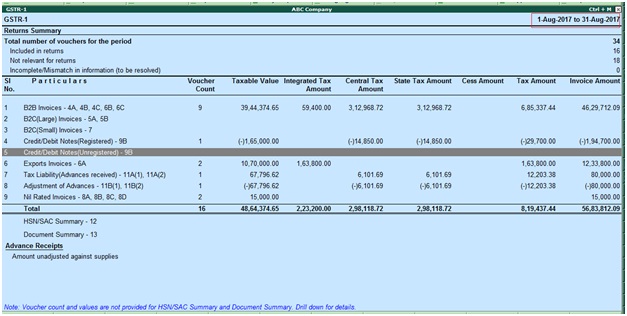

GSTR1 includes B2B invoices, B2C large invoices, B2C small invoices, credit/debit notes (Registered), credit or debit notes (Unregistered), exports, tax liability advance received with adjustment and nil rated invoices.

How to View GSTR-1 Report in Tally.ERP9

Path: Gateway of Tally -> Display -> Statutory Reports -> GST -> GSTR1

Select the period: 1st August 2017 to 31st August 2017

If the GSTR1 report will not display like above then you need to enable the below options.

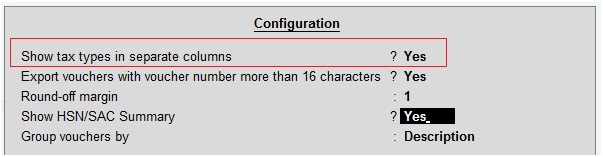

During the same screen click on F12 Configure

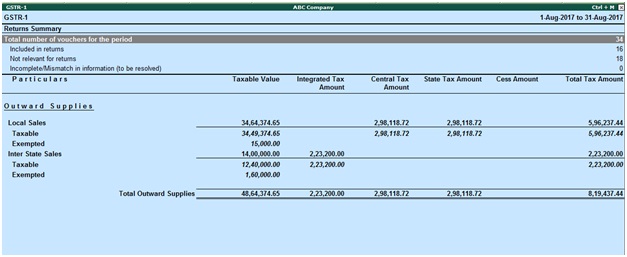

To view the report in summary view

Path: Gateway of Tally -> Display -> Statutory Reports -> GST -> GSTR1

During the same screen click on view summary

Click on F1 detailed

Return summary: It indicates business operations during the particular period

Particulars: You can view the taxable value and tax amount from outward supplies considered in the returns.

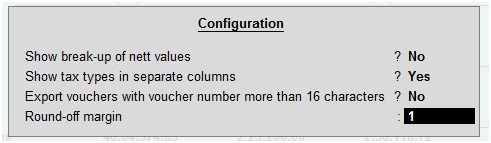

During the same screen click on F12: Configure

Show break-up of nett values: This option was disabled by default. You have to enable this option to display gross value, returns and addition/deduction values in detailed mode of the GSTR1 report.

Show tax types in separate columns: Enable this option if you want to view the all GST tax types in separate columns.

When this option was not enabled then the tax amount is displayed in a single column without central tax, state tax and integrated tax amount break up.

Export vouchers with the voucher number more than 16 characters: You have to enable this option to export the transactions having more than 16 characters, including special characters to the template.

Round-off-margin: It is set to 1 by default. You can change it as required to ensure the relevant transactions are included in returns.

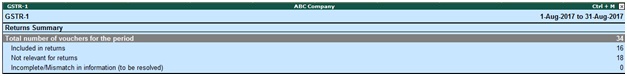

GSTR-1 Returns Summary

This section indicates a summary of all transactions recorded in the particular period. You can view details by drill down each row.

Total number of vouchers for the period

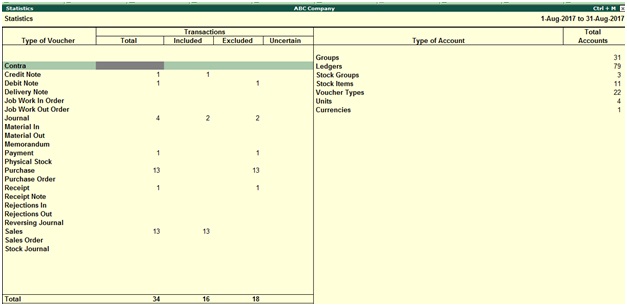

Keep the cursor on total number of vouchers for the period in the above screen and press enter and drill down it shows the Statistics.

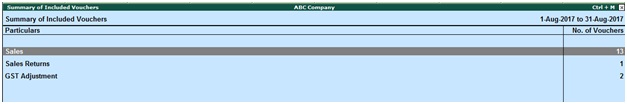

Included in returns

To view the summary of included vouchers report, you need to drill down from this row to view the list of voucher types with voucher count.

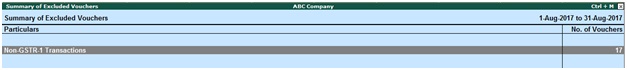

Not relevant for returns

To view the summary of Excluded vouchers report then you need to drill down from this row to view the transaction type-wise voucher count.

Other transaction types

Excluded by user: The transactions have been excluded by you manually from the list of included transactions and drill down and use include voucher if required. Based on the information in the voucher it will move to either included or uncertain.

Contra vouchers: The count of contra vouchers which involve only bank and cash ledgers.

Order vouchers: The count of purchase order, sales order, job work in order and job work out order vouchers.

Inventory vouchers: The count of receipt note, stock journal, delivery note, material in, material out, rejections in, rejections out and physical stock vouchers as they are purely inventory in nature and do not attract GST.

Payroll vouchers: The transactions have been recorded by using payroll and attendance vouchers. GST does not apply on these transactions.

No GST Implications: The count of payments, receipts and journal vouchers that do not have any GST implication.

Other voucher: The count of memorandum and reversing journal vouchers

Non GSTR-1 transactions: The transactions which are part of the other returns, example, GSTR-2 related to purchase transactions, hence will not have any implication on GSTR-1.

All the transaction types have not been displayed by default. Based on the voucher type used and the exclusions done by you, the relevant categories appear with the voucher count.

Incomplete/Mismatch in information (to be resolved)

It indicates the count of all vouchers with the insufficient information related to GST. You have to correct the mismatch information in the vouchers before exporting the return.

Related Topics

Related Pages

- How to Post TDS Receivable Entry in Tally ERP9

- List of Shortcut Keys in Tally ERP9

- Enable TDS in Tally ERP9

- GST Classifications in Tally ERP9

- Import of Goods under GST in Tally ERP9

- Sales to Unregistered Dealer in Tally ERP9

- Input Service Distributor under GST in Tally ERP9

- How to Activate GST in Tally ERP9

- How to Enable TDS in Tally ERP9

- TDS on Professional Charges in Tally ERP9

- GSTR-2 Report in Tally ERP9

- GSTR-3B Report in Tally ERP9

- What is Tally ERP9

- How to Create Company in Tally ERP9

- List of Ledgers and Groups in Tally ERP9

- How to Create, Display, Alter and Delete Ledgers in Tally ERP9

- How to Create, Display, Alter and Delete Group in Tally ERP9

- Sales Voucher in Tally ERP9

- Purchase Voucher in Tally ERP9

- Recording of GST Intrastate Sales in Tally ERP9