Recording of GST Intrastate Sales in Tally ERP9

Once you activate GST for your company, then you can record sale of goods or services by using the sales voucher in Tally.ERP9.

The SGST and CGST will be applicable in case of intra-state (Within State) transactions.

Ledgers Creation

Path: Gateway of Tally -> Accounts Info -> Ledgers -> Create

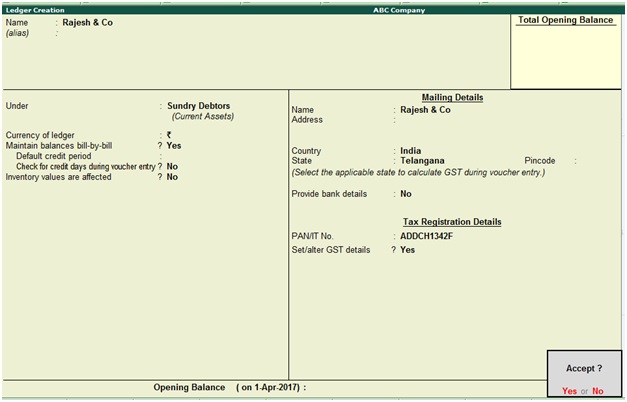

Name: Rajesh & Co

Under: Sundry Debtors

Press Enter to save the screen

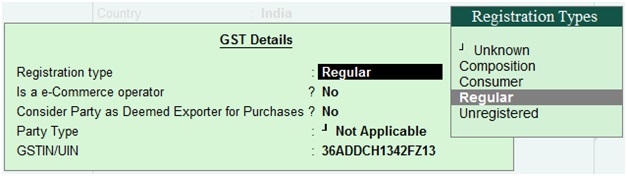

Registration type: Regular

GSTIN/UIN: Enter customer GSTIN number

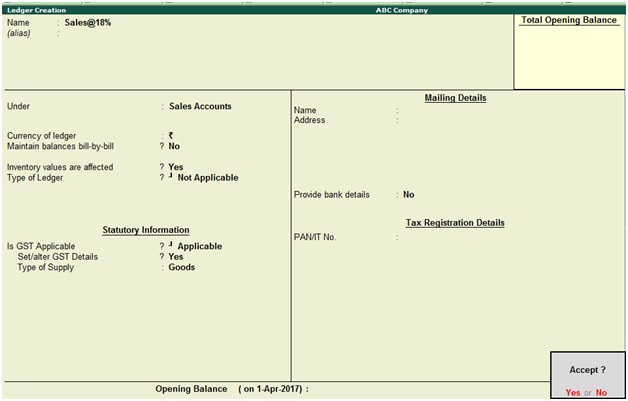

Ledger Name: Sales@18%

Under: Sales Accounts

Is GST Applicable: Applicable

Set/alter GST details: Yes, once enable this option then the below GST details for ledger screen will appear.

Press enter to save the screen

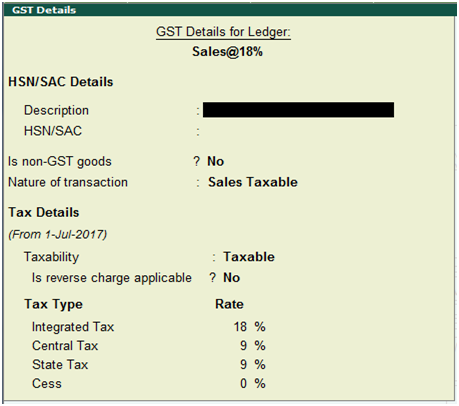

Nature of transaction: Sales Taxable

Taxability: Taxable

Tax Rate: Set the GST tax rate @18%

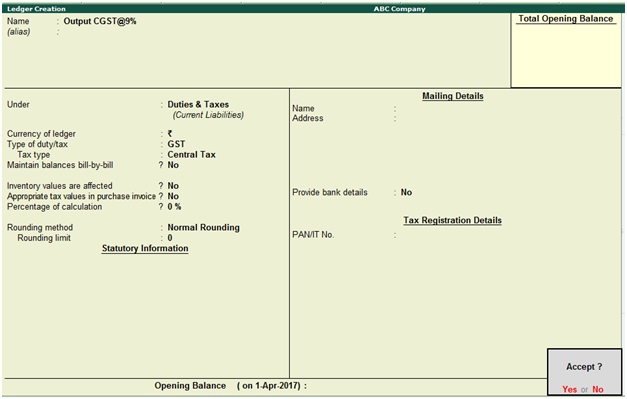

Ledger Name: Output CGST@9%

Under: Duties & Taxes

Type of duty/tax: GST

Tax type: Central Tax

Press enter to save the screen

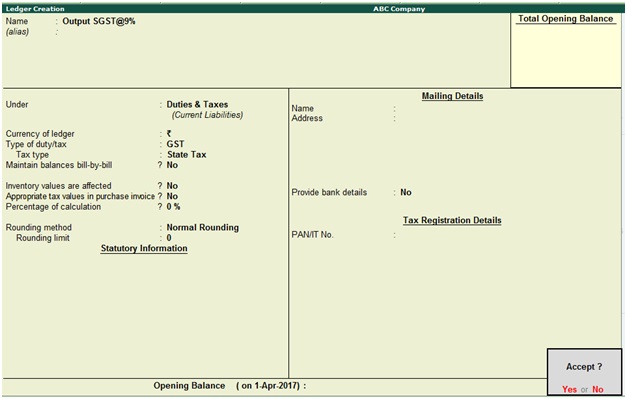

Ledger Name: Output SGST@9%

Under: Duties & Taxes

Type of duty/tax: GST

Tax type: State Tax

Press enter to save the screen

How to Record GST Intrastate Sales in Tally ERP9

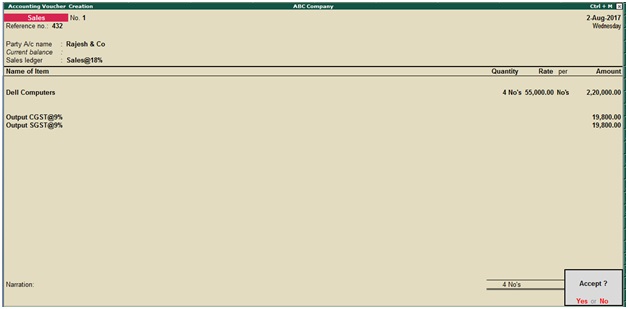

Path: Gateway of Tally -> Accounting vouchers -> F8 Sales

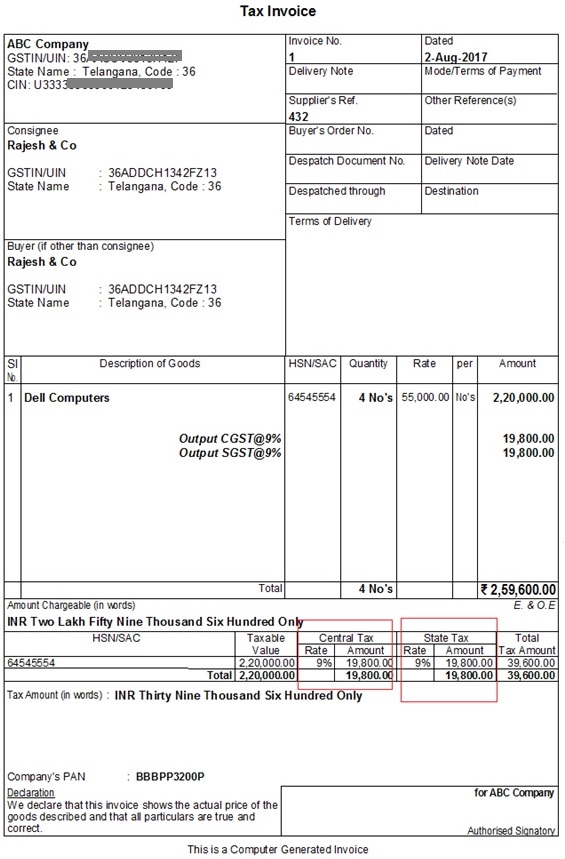

Example: Sold 4 Dell computers to Rajesh & Co each @55,000 with GST@18% (CGST@9% and SGST@9%)

Invoice Reference no: 432 (Enter invoice number)

Date: 02.08.2017 (Enter invoice date)

Select the sale ledger

Select the name of item

Select the output CGST and output SGST tax ledgers

Press enter to save the screen

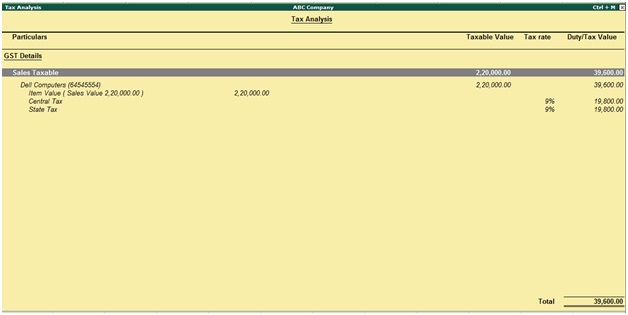

Click on Tax Analysis to view the tax details

Click on F1 detailed

How to generate GST Tax Invoice in Tally ERP9

During the sales voucher screen press Alt+P to print invoice

Print? Click on Yes

Related Topics

Import of Goods under GST in Tally ERP9

Sales to Unregistered Dealer in Tally ERP9

GST Sales with Discount at Item Level in Tally ERP9

Related Pages

- How to Post TDS Receivable Entry in Tally ERP9

- List of Shortcut Keys in Tally ERP9

- Enable TDS in Tally ERP9

- GST Classifications in Tally ERP9

- Import of Goods under GST in Tally ERP9

- Sales to Unregistered Dealer in Tally ERP9

- Input Service Distributor under GST in Tally ERP9

- How to Activate GST in Tally ERP9

- How to Enable TDS in Tally ERP9

- TDS on Professional Charges in Tally ERP9

- GSTR-1 Report in Tally ERP9

- GSTR-2 Report in Tally ERP9

- GSTR-3B Report in Tally ERP9

- What is Tally ERP9

- How to Create Company in Tally ERP9

- List of Ledgers and Groups in Tally ERP9

- How to Create, Display, Alter and Delete Ledgers in Tally ERP9

- How to Create, Display, Alter and Delete Group in Tally ERP9

- Sales Voucher in Tally ERP9

- Purchase Voucher in Tally ERP9