GSTR-3B Report in Tally ERP9

Form GSTR-3B is an interim GST return form for the regular registration dealers of GST and they need to file monthly returns.

You can easily generate the GSTR-3B, and export the data in the JSON format and upload it on portal to file the returns.

How to view the GSTR-3B repot in Tally ERP9

Path: Gateway of Tally -> Display -> Statutory Reports -> GST -> GSTR-3B

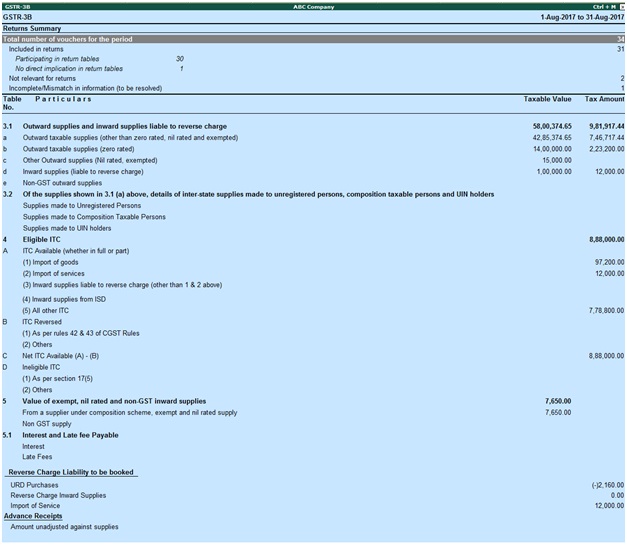

Click on View Summary

The summary view will provide the tax computation details with taxable value and break-up of tax.

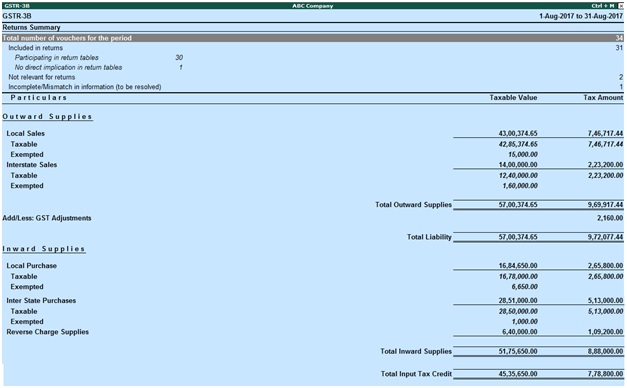

Return Summary

This sections indicates business operations for the particular period

Total number of vouchers for the period

Keep the cursor on total number of vouchers for the period and press enter and drill down shows the Statistics

Include returns

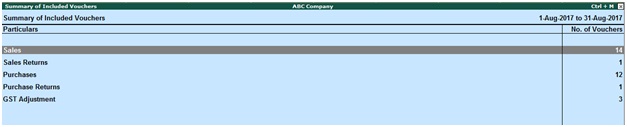

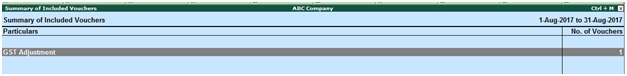

To view the summary of included vouchers part of the return, you have to drill down from this row to view the list of voucher types with voucher count.

No direct implication in return tables: You can able to see the number of vouchers have been recorded that do not have an impact on the GSTR-3B returns.

Drill down to view the summary of included vouchers in GSTR-3R report.

Not relevant for returns

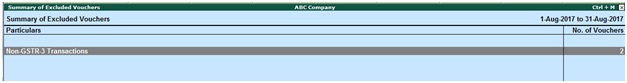

To view the summary of Excluded vouchers, you have to drill down from this row to view the transactions that are excluded from the return.

Incomplete/Mismatch in information (to be resolved)

The count of all vouchers with the insufficient GST related information. You have to correct the mismatch information in the vouchers to include them in the returns.

Particulars

It indicates taxable value and tax amount from outward and inward supplies considered in the returns.

Return Format View

Click on view return format, it displays the values in the actual GSTR-3B form format. The values in the form have been captured under different sections.

Related Topics

Related Pages

- How to Post TDS Receivable Entry in Tally ERP9

- List of Shortcut Keys in Tally ERP9

- Enable TDS in Tally ERP9

- GST Classifications in Tally ERP9

- Import of Goods under GST in Tally ERP9

- Sales to Unregistered Dealer in Tally ERP9

- Input Service Distributor under GST in Tally ERP9

- How to Activate GST in Tally ERP9

- How to Enable TDS in Tally ERP9

- TDS on Professional Charges in Tally ERP9

- GSTR-1 Report in Tally ERP9

- GSTR-2 Report in Tally ERP9

- What is Tally ERP9

- How to Create Company in Tally ERP9

- List of Ledgers and Groups in Tally ERP9

- How to Create, Display, Alter and Delete Ledgers in Tally ERP9

- How to Create, Display, Alter and Delete Group in Tally ERP9

- Sales Voucher in Tally ERP9

- Purchase Voucher in Tally ERP9

- Recording of GST Intrastate Sales in Tally ERP9