Recording of GST Local Purchases in Tally ERP9

You can record the purchase transactions in Tally.ERP9 after updating of GST details for your company and the creation of necessary ledger masters.

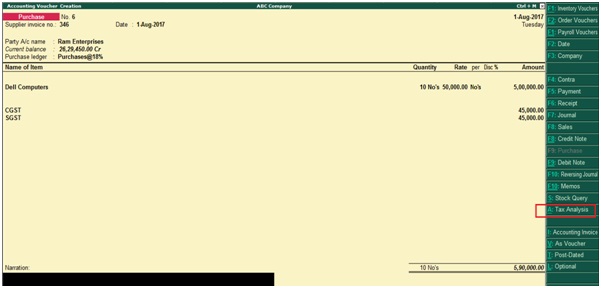

Path: Gateway of Tally -> Accounting Vouchers -> (F9) Purchases

Example: Purchased 10 Dell computers from Ram Enterprise each@ Rs. 50,000 with GST@18%.

Note: If you purchase from local supplier then SGST & CGST will attract (SGST@9% and CSGT@9%)

Supplier Invoice No: 346 (Enter supplier invoice number)

Invoice Date: 1.08.2017 (Enter invoice date)

Party Name: Ram Enterprises (Enter supplier name)

Name of Item: Select name of item

Quantity: 10 (Enter quantity as per invoice)

CSGT and SGST will be calculated automatically based on GST classification and GST rate.

Click on Yes to Accept and save the entry

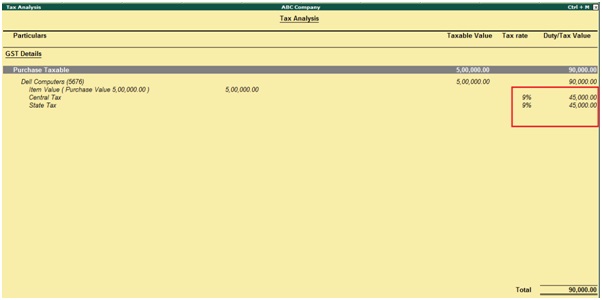

Before you accept and save the entry, click on Tax Analysis in the above screen, then the below Tax Analysis screen will appear and click on detailed (Alt+F1) to view the GST tax details.

Select new ref in bill-wise details screen and while making payment to the supplier (Ram Enterprises) you need to select the same ref number i.e. 346.

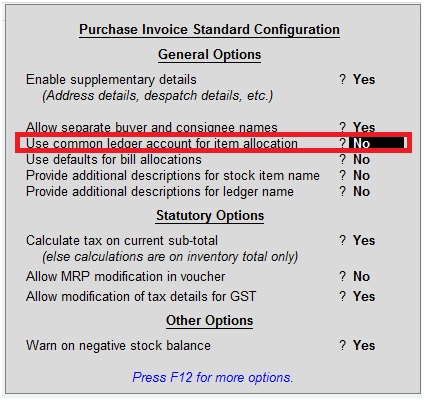

Example 2: Purchase invoice posting without using common ledger account for item allocation.

In case if you bought different stock items with different tax rates.

During purchase voucher screen (F9) Press F12 configure then the below screen will appear.

Use common ledger account for item allocation: No

Press enter

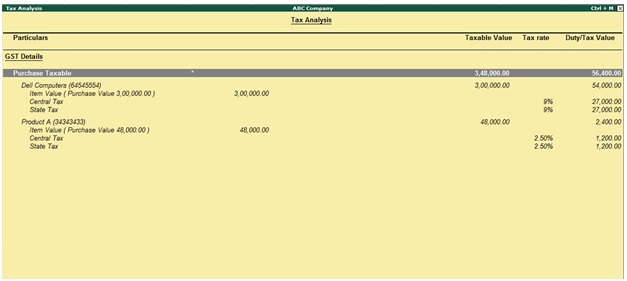

Example: Purchased below stock items from Ram enterprises

Dell computers 6 quantity @ 50000 each with GST@18%

Product A 12 quantity @ 4000 each with GST@5%

During the same screen, click on Tax Analysis then the below screen will appear and click on detailed (Alt+F1) to view the stock item wise GST tax details.

Related Topics

GST Classifications in Tally ERP9

How to Activate GST in Tally ERP9

Creation of Stock Items for GST in Tally ERP9

Related Pages

- How to Post TDS Receivable Entry in Tally ERP9

- List of Shortcut Keys in Tally ERP9

- Enable TDS in Tally ERP9

- GST Classifications in Tally ERP9

- Import of Goods under GST in Tally ERP9

- Sales to Unregistered Dealer in Tally ERP9

- Input Service Distributor under GST in Tally ERP9

- How to Activate GST in Tally ERP9

- How to Enable TDS in Tally ERP9

- TDS on Professional Charges in Tally ERP9

- GSTR-1 Report in Tally ERP9

- GSTR-2 Report in Tally ERP9

- GSTR-3B Report in Tally ERP9

- What is Tally ERP9

- How to Create Company in Tally ERP9

- List of Ledgers and Groups in Tally ERP9

- How to Create, Display, Alter and Delete Ledgers in Tally ERP9

- How to Create, Display, Alter and Delete Group in Tally ERP9

- Sales Voucher in Tally ERP9

- Purchase Voucher in Tally ERP9