Adjustments Against Tax Credit under GST in Tally ERP9

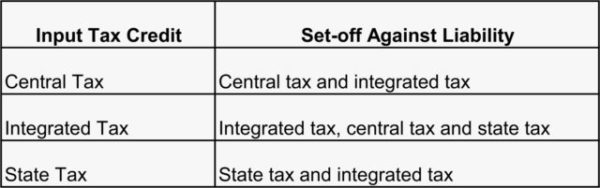

In order to set off the tax liability of central tax, integrated tax and state tax under GST as follows.

You have to set-off the above tax liability as per the below following order.

Example

Output Tax details as follows

Central tax (CGST) payable on outward supply of Rs.20,000

Integrated tax (IGST) payable on outward supply of Rs.26,000

State tax (SGST) payable on outward supply of Rs.20,000

Input tax details as follows

Central tax (CGST) paid on purchases of Rs.16,000

Integrated tax (IGST) paid on purchases of Rs.32,000

State tax (SGST) pad on purchases of Rs.16,000

Output IGST – Input IGST

26,000 – 32,000 = – 6,000 Available Input IGST

Output CGST – Input CGST

20,000 – 16,000 = 4,000 CGST payable amount

Output SGST – Input SGST

20,000 – 16,000 = 4,000 SGST payable amount

Step 1

As per the above example available input IGST amount is Rs.6,000 after set-off input IGST.

Step 2

As per the above example CGST payable amount is Rs.4,000 after set-off input CGST and you can adjust available input IGST against CGST payable.

CGST Payable amount is Rs.4000

Less: Adjust available input IGST paid on purchases Rs.4000

Now, the CGST Payable is “Zero”

Available input IGST is Rs. 2,000 (6,000- 4,000)

Note

You cannot set-off available input SGST against CGST payable amount

Step 3

As per the above example SGST payable amount is Rs.4,000 after set-off input SGST and you can adjust available input IGST against SGST payable.

SGST payable amount is Rs.4,000

Less: Available input IGST is Rs. 2,000

Net SGST Payable amount is Rs. 2,000

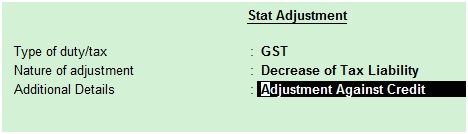

How to record a journal voucher for utilization of tax credits

Path: Gateway of Tally -> Accounting vouchers -> F7 Journal

Click on Stat Adjustment

Type of duty/tax: GST

Nature of adjustment: Decrease of Tax Liability

Additional Details: Adjustment against Credit

Adjustment Entries for the above example

Output IGST Dr 26,000

To Input IGST 26,000

Output CGST Dr 4,000

To Input IGST 4,000

Output SGST Dr 2,000

To Input IGST 2,000

Related Topics

Sales to Consumers under GST in Tally ERP9

Recording of GST Inter-State Purchases in Tally ERP9

Related Pages

- How to Post TDS Receivable Entry in Tally ERP9

- List of Shortcut Keys in Tally ERP9

- Enable TDS in Tally ERP9

- GST Classifications in Tally ERP9

- Import of Goods under GST in Tally ERP9

- Sales to Unregistered Dealer in Tally ERP9

- Input Service Distributor under GST in Tally ERP9

- How to Activate GST in Tally ERP9

- How to Enable TDS in Tally ERP9

- TDS on Professional Charges in Tally ERP9

- GSTR-1 Report in Tally ERP9

- GSTR-2 Report in Tally ERP9

- GSTR-3B Report in Tally ERP9

- What is Tally ERP9

- How to Create Company in Tally ERP9

- List of Ledgers and Groups in Tally ERP9

- How to Create, Display, Alter and Delete Ledgers in Tally ERP9

- How to Create, Display, Alter and Delete Group in Tally ERP9

- Sales Voucher in Tally ERP9

- Purchase Voucher in Tally ERP9