Sales to consumers under GST in Tally ERP9

You can record sales to consumers (end user of the goods or services) by using a sales voucher in Tally.

Based on the location and value of the transaction the invoice will be captured in different tables in GSTR-1 report.

If the invoice value of interstate sales is more than Rs.2.5 lakh then the transaction will be captured under B2C (Large) Invoices.

In case local sales irrespective of invoice value will be captured under B2C (Small) Invoices and also interstate sales invoice value is less than Rs.2.5 lakh will be captured under this table.

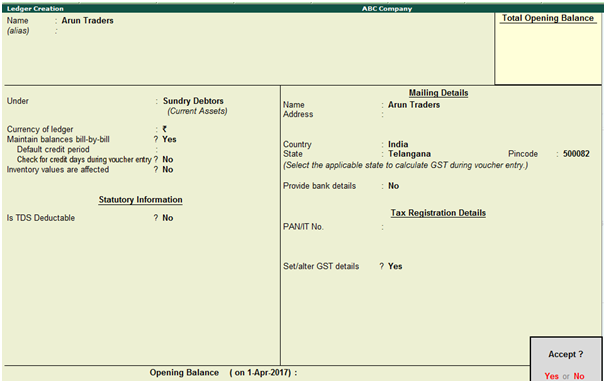

Ledgers Creation

Path: Gateway of Tally -> Accounts Info -> Ledgers -> Create

Name: Arun Traders (Local customer)

Under: Sundry Debtors

Maintain balance bill by bill: Yes

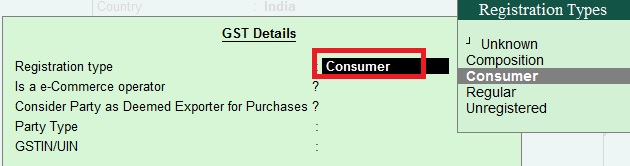

Set/alter GST details: Yes, once enable this option then the below GST details screen will appear.

Registration type: Consumer

Press enter to save the screen

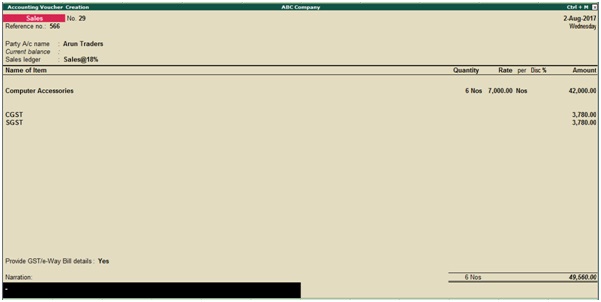

Record consumer sales invoice in Tally.ERP9

Path: Gateway of Tally -> Accounting Vouchers -> F8 Sales

Press enter to save the screen

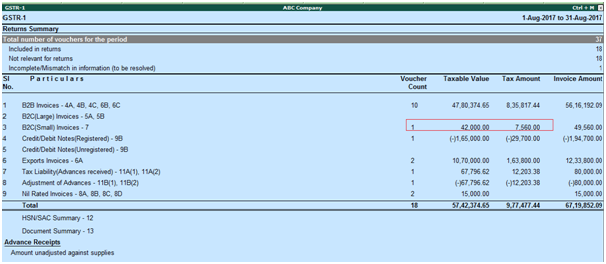

Check GSTR-1 Report

Path: Gateway of Tally -> Display -> Statutory Reports -> GST -> GSTR-1

Similarly record interstate sales with different invoice values like, record sales invoices less than and more than Rs2.5 lakh and check the GSTR-1 Report under B2C (Small) invoices & B2C (Large) Invoices.

Also, Create other state customer ledger and select registration type as Consumer and record sales invoice and check the impact in GSTR-1 Report.

Related Topics

GST Sales with Discount at Item Level in Tally ERP9

TDS Rate Chart for Financial Year 2018-2019

Interest on Late Payment of TDS

Related Pages

- How to Post TDS Receivable Entry in Tally ERP9

- List of Shortcut Keys in Tally ERP9

- Enable TDS in Tally ERP9

- GST Classifications in Tally ERP9

- Import of Goods under GST in Tally ERP9

- Sales to Unregistered Dealer in Tally ERP9

- Input Service Distributor under GST in Tally ERP9

- How to Activate GST in Tally ERP9

- How to Enable TDS in Tally ERP9

- TDS on Professional Charges in Tally ERP9

- GSTR-1 Report in Tally ERP9

- GSTR-2 Report in Tally ERP9

- GSTR-3B Report in Tally ERP9

- What is Tally ERP9

- How to Create Company in Tally ERP9

- List of Ledgers and Groups in Tally ERP9

- How to Create, Display, Alter and Delete Ledgers in Tally ERP9

- How to Create, Display, Alter and Delete Group in Tally ERP9

- Sales Voucher in Tally ERP9

- Purchase Voucher in Tally ERP9