Create GST Tax Ledgers in Tally ERP9

You have to create GST tax ledgers in Tally for each tax type to record the sales and purchase transactions with the GST details.

SGST – This will be applicable in case of intrastate supplies both goods and services

CGST – This will be applicable in case of intrastate supplies both goods and services

IGST – This will be applicable in case of interstate supplies both goods and services and also applicable in both cases of import into India and export from India.

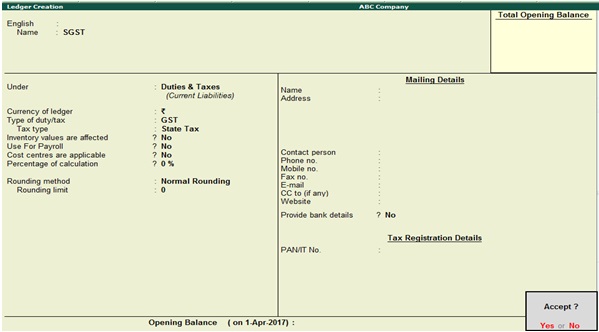

SGST Ledger Creation

Path: Gateway of Tally -> Accounting Info -> Ledgers-> Create

Name of Ledger: SGST

Under: Duties & Taxes

Type of duty/tax: GST

Tax Type: State Tax

Inventory values are affected: No

Rounding Method: Normal rounding

Click on Yes to accept and save the entry

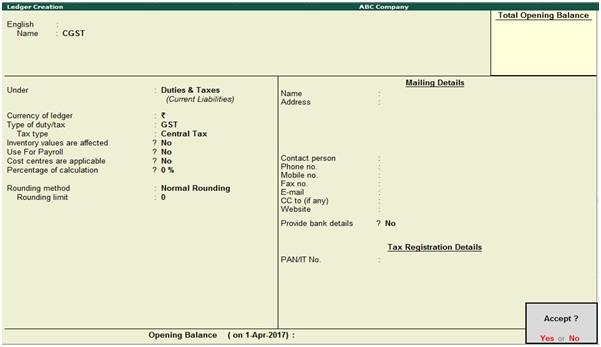

CGST Ledger Creation

Under: Duties & Taxes

Type of duty/tax: GST

Tax Type: Central Tax

Inventory values are affected: No

Rounding Method: Normal rounding

Click on Yes to accept and save the entry

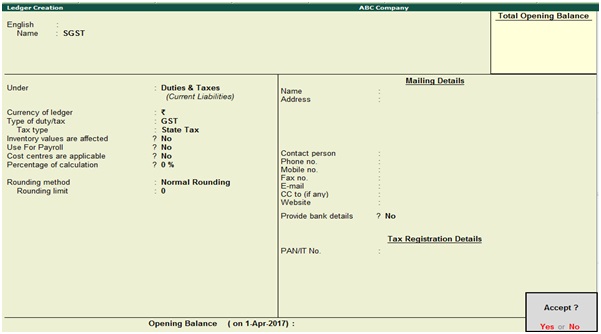

IGST Ledger Creation

Under: Duties & Taxes

Type of duty/tax: GST

Tax Type: Integrated Tax

Inventory values are affected: No

Rounding Method: Normal rounding

Click on Yes to accept and save the entry

Related Topics

Purchase Voucher in Tally ERP9

List of Ledgers and Groups in Tally ERP9

Related Pages

- How to Post TDS Receivable Entry in Tally ERP9

- List of Shortcut Keys in Tally ERP9

- Enable TDS in Tally ERP9

- GST Classifications in Tally ERP9

- Import of Goods under GST in Tally ERP9

- Sales to Unregistered Dealer in Tally ERP9

- Input Service Distributor under GST in Tally ERP9

- How to Activate GST in Tally ERP9

- How to Enable TDS in Tally ERP9

- TDS on Professional Charges in Tally ERP9

- GSTR-1 Report in Tally ERP9

- GSTR-2 Report in Tally ERP9

- GSTR-3B Report in Tally ERP9

- What is Tally ERP9

- How to Create Company in Tally ERP9

- List of Ledgers and Groups in Tally ERP9

- How to Create, Display, Alter and Delete Ledgers in Tally ERP9

- How to Create, Display, Alter and Delete Group in Tally ERP9

- Sales Voucher in Tally ERP9

- Purchase Voucher in Tally ERP9