Fixed Assets Process in Tally ERP9

Fixed Assets are purchased for long term and business operations purpose to generate income and which cannot be easily converted into cash, such as furniture, plant and machinery, land, building and office equipment etc.

Fixed Asset Group

Similar nature of fixed assets will group under one head for easy reporting purpose.

Examples for Fixed Asset Groups

Computer & Peripherals

Furniture

Vehicles

Buildings

Examples for Fixed Assets

Desktop Computers

Laptops

Office Tables

Audi Car

Maruthi Swift

House No.403

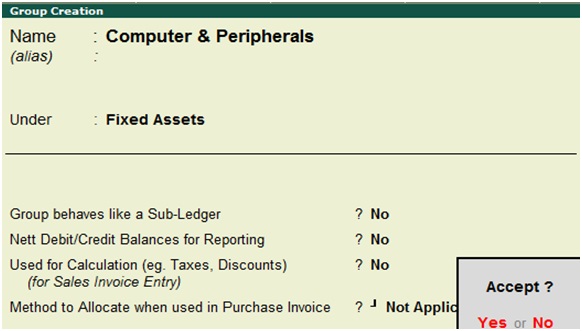

Creation of Fixed Asset Groups in Tally ERP9

Path: Go To Gateway of Tally -> Accounts Info -> Group-> Create

Fixed Asset Group Name: Computer & Peripherals

Under: Fixed Assets

Press enter to save the screen

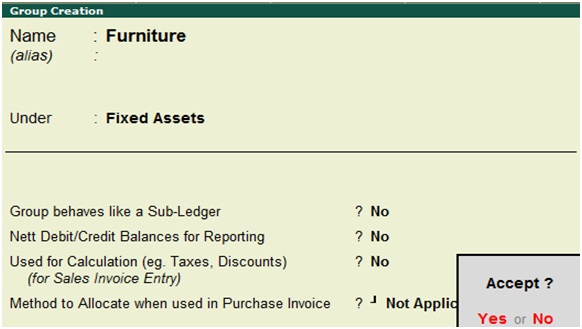

Name of Asset Group: Furniture

Under: Fixed Assets

Press enter to save the screen

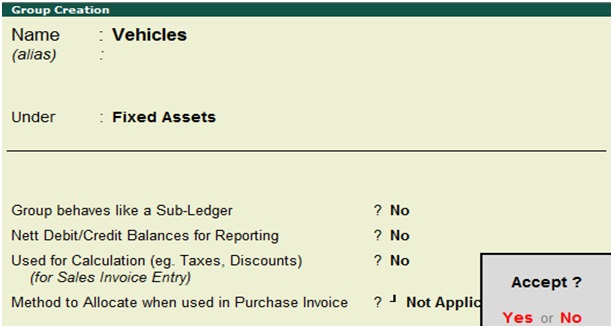

Name of Asset Group: Vehicles

Under: Fixed Assets

Press Enter to save the screen

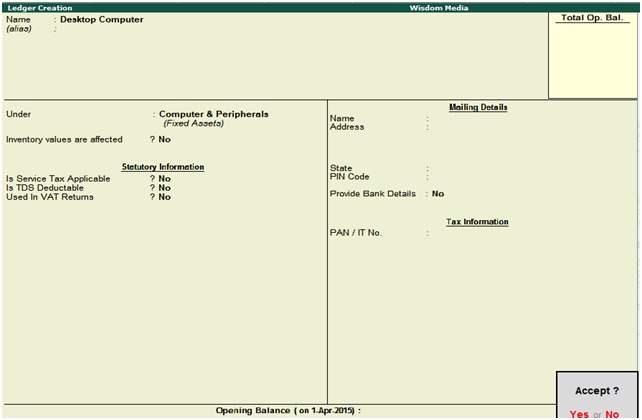

Fixed Assets Creation in Tally ERP9

Path: Gateway of Tally -> Accounts Info -> Ledger-> Create

Name: Desktop Computer

Under: Computer & Peripherals

Press Enter to save the screen

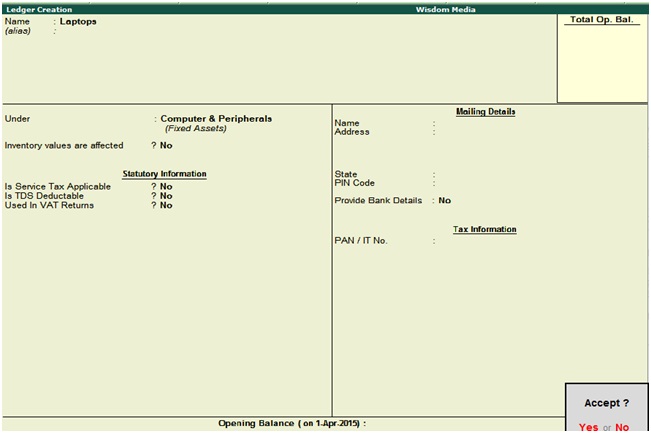

Name of Fixed Asset: Laptops

Under: Computer & Peripherals

Press Enter to save the screen

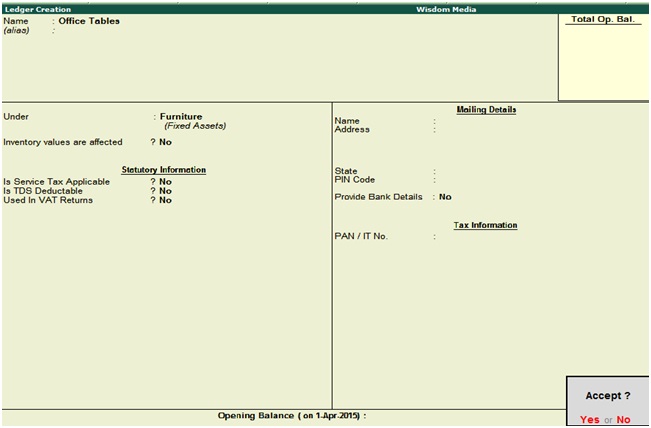

Name of Fixed Asset: Office Tables

Under: Furniture

Press Enter to save the screen

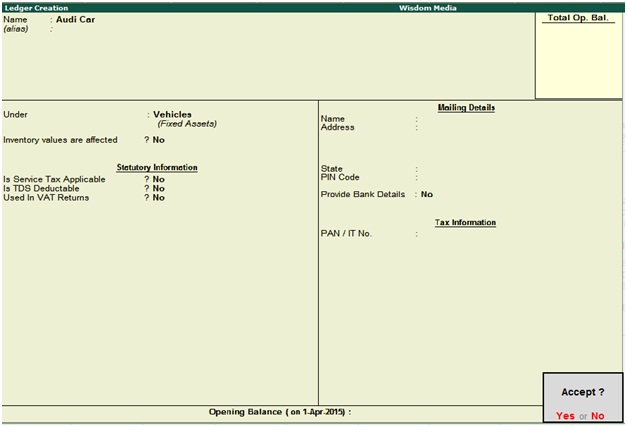

Name of Fixed Asset: Audi Car

Under: Vehicles

Press Enter to save the screen

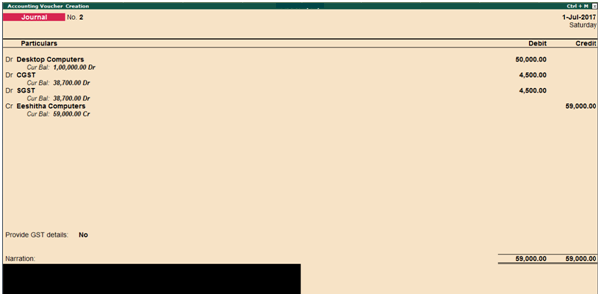

How to record asset purchase transaction in Tally ERP9

Fixed Asset acquisition transactions will record in Journal voucher (F7).

Fixed Asset purchase on credit

Desktop Computer Dr 50,000

CGST Dr 4,500

SGST Dr 4,500

To Eeshitha Computers 50,000

Payment to Vendor

Path: Gateway of Tally -> accounting vouchers -> F5 payment

Eeshitha Computers a/c Dr 59,000

To Cash/Bank a/c 59,000

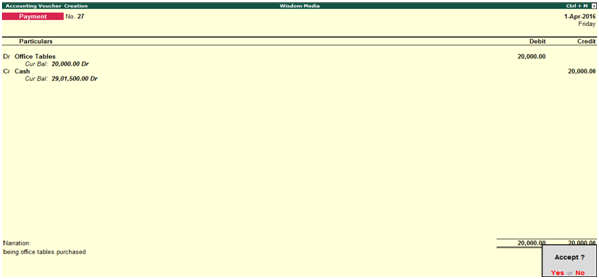

Fixed Asset Purchase with Cash

You have to record the following accounting entry, if you purchase fixed assets, paying in cash.

Entry

Office Tables A/c Dr

To Cash A/c

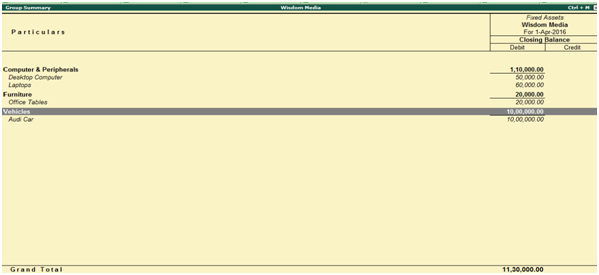

Fixed Assets Report

Path: Gateway of Tally -> Balance Sheet -> Fixed Assets

The above screen shot indicates group wise fixed assets summary.

How to record depreciation entry in Tally ERP9

Depreciation is a systematic reduction of value from fixed asset due to wear and tear.

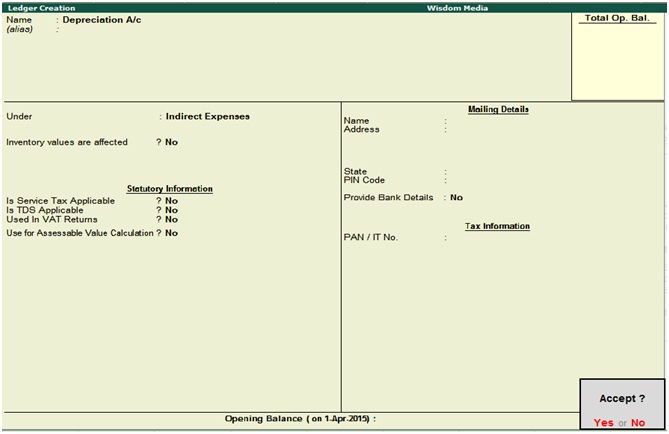

Depreciation Ledger Creation in Tally ERP9

Under: Indirect Expenses

Press enter to save the screen

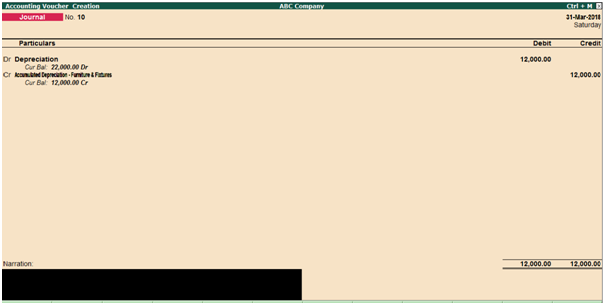

Depreciation Entry

Depreciation A/c Dr

To Accumulated depreciation – Furniture & Fixtures

Related Topics

Bank Reconciliation in Tally ERP9

Interest Calculation in Tally ERP9

Cost Centre and Cost Category in Tally ERP9

Related Pages

- How to Post TDS Receivable Entry in Tally ERP9

- List of Shortcut Keys in Tally ERP9

- Enable TDS in Tally ERP9

- GST Classifications in Tally ERP9

- Import of Goods under GST in Tally ERP9

- Sales to Unregistered Dealer in Tally ERP9

- Input Service Distributor under GST in Tally ERP9

- How to Activate GST in Tally ERP9

- How to Enable TDS in Tally ERP9

- TDS on Professional Charges in Tally ERP9

- GSTR-1 Report in Tally ERP9

- GSTR-2 Report in Tally ERP9

- GSTR-3B Report in Tally ERP9

- What is Tally ERP9

- How to Create Company in Tally ERP9

- List of Ledgers and Groups in Tally ERP9

- How to Create, Display, Alter and Delete Ledgers in Tally ERP9

- How to Create, Display, Alter and Delete Group in Tally ERP9

- Sales Voucher in Tally ERP9

- Purchase Voucher in Tally ERP9