Bank Reconciliation Statement in Tally ERP9

Bank reconciliation is a process and it indicates the difference on a specified date or particular period between balance shown in pass book (bank statement) and balance shown in bank ledger (Tally). By preparing the bank reconciliation statement will find the causes of difference between the bank ledger and bank statement.

You have to do the bank reconciliation monthly each bank account wise.

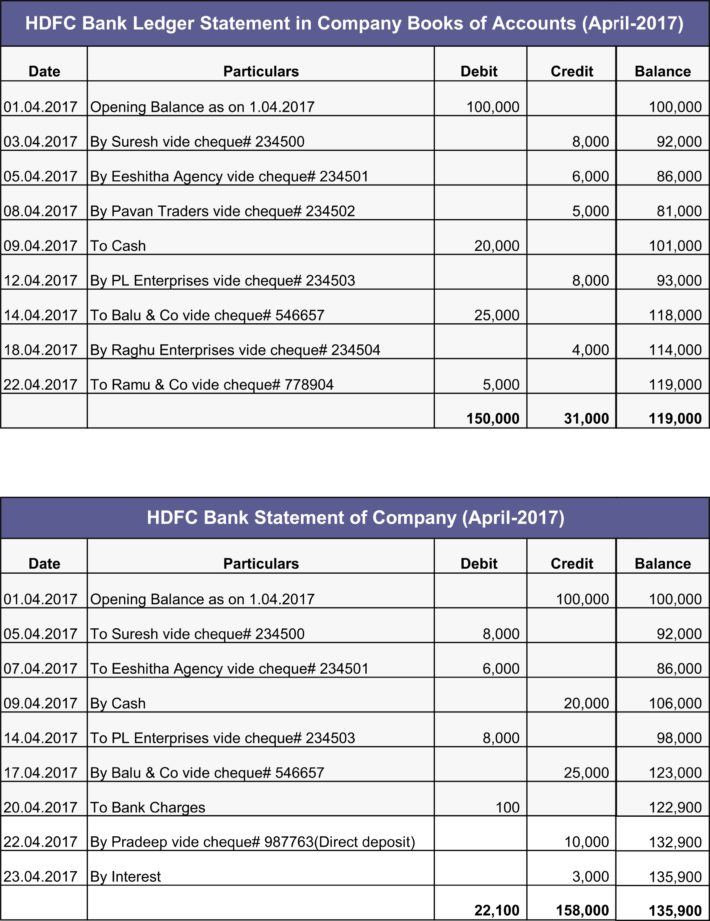

Example

Bank reconciliation for the period of 1st April 2017 to 30th April 2017

Bank Reconciliation Process

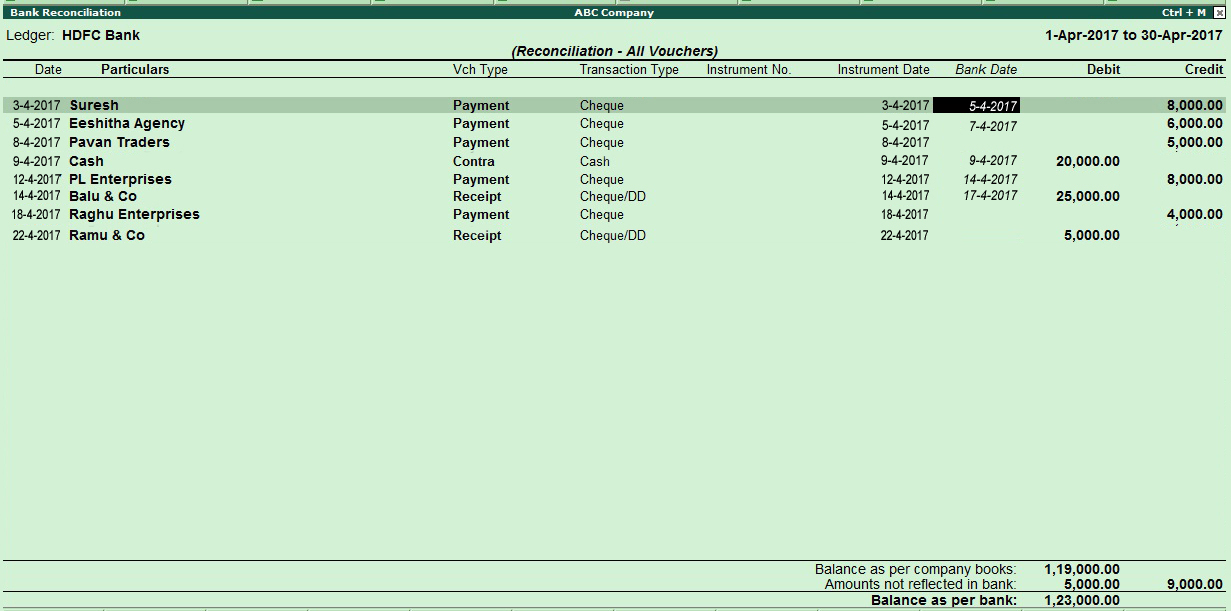

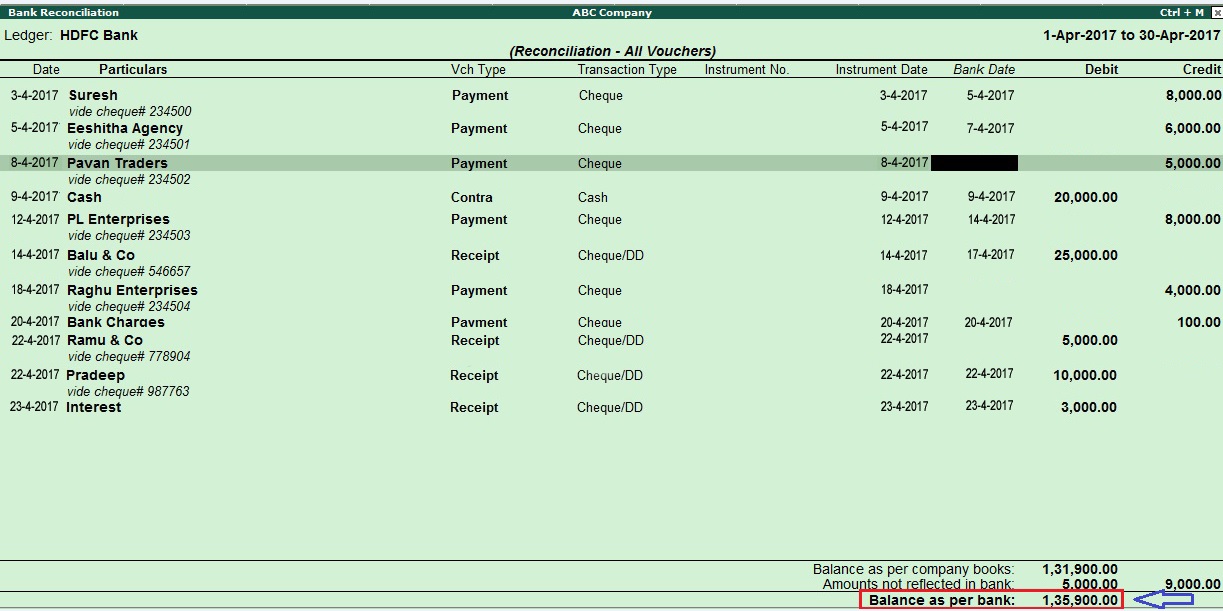

The first screen shot indicates bank ledger balance as per the company books of records for the period of April 2017.

The above second screen shot indicates pass book balance as per the bank statement for the period of April 2017.

Step 1

First you have to download the bank statement for the reconcile period.

Step 2

You have to verify as per the company books of accounts all issued cheques have been cleared by the bank during the reconcile period (April 2017).

You have to verify as per the company books of accounts all deposited cheque payments have been collected by the bank during the reconcile period (April 2017).

Example, received a cheque from the customer on 28th April 2017, the same has been deposited in bank. However, it may take a few days to clear in the bank account. Hence the balance as per bank ledger in Tally will not match with balance as per bank statement, because, you have recorded cheque deposited entry on 28th April 2017 in Tally but the cheque got cleared on 1st May 2017.

Step 3

If you find any transactions are recorded in the pass book (Bank Statement) and not recorded in the cash book (Company books of accounts or Tally) then you should record those missing transactions in company books of records (Tally) to make it equal to the bank statement balance.

Example: Bank charges deducted by the bank, customer directly deposited cheque in bank account, bank interest and any auto debits.

Step 4

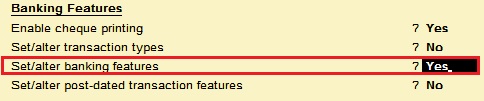

How to enable banking features in Tally

Path: Gateway of Tally -> F11 Features -> Accounting Features

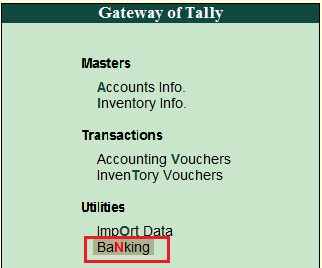

Set/alter transaction features: Yes, once enable this option, and then you will find Banking option in Gateway of Tally screen.

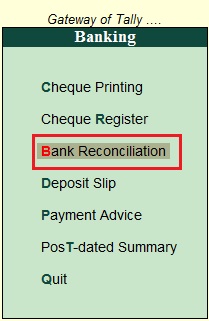

Click on Banking option, once you click on this option then the below screen will appear

Click on Bank Reconciliation

Select the bank ledger from the list of bank ledgers for which bank account you want to do the bank reconciliation.

You have to enter bank clearing date in bank date field as per the bank statement as shown in the above screen.

Example: As per the first screen shot of the company bank ledger account, the cheque has been issued to suresh of Rs.6000 vide cheque# 234500 dated on 03.04.2017, the same has been cleared on 05.04.2017 as per the pass-book (Bank Statement), the same clearing date you should enter in the bank date field while doing the bank reconciliation.

Like the same you have to enter the bank clearing date for all issued and deposited cheques as per the passbook.

Step 5

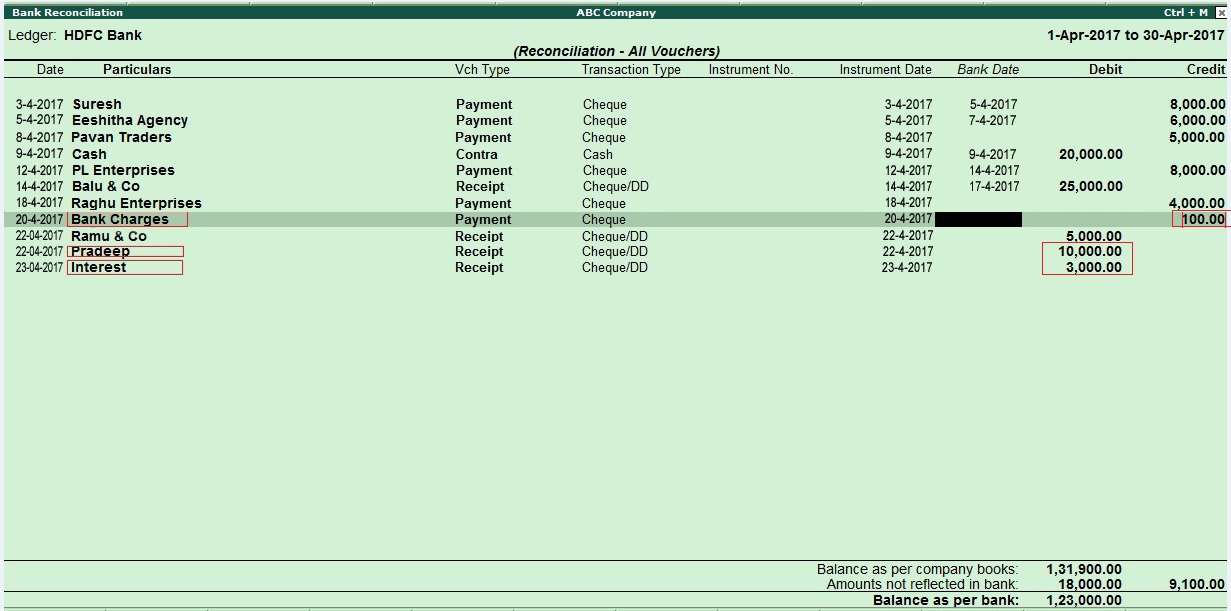

The following transactions are recorded in pass book, but not recorded in the bank ledger account in company books of accounts (Tally) and those transactions you have to record in Tally.ERP9 like as shown in the below.

As per the pass-book bank charges deducted by the bank on 20.04.2017, record the entry in Tally on same date as shown below.

Bank Charges A/c Dr

To HDFC Bank

As per the pass-book customer (Pradeep) has directly deposited by the cheque on 22.04.2017, record the entry in Tally on the same date as shown below.

HDFC Bank A/c Dr

To Pradeep A/c

As per the pass-book interest credited by the bank on 23.04.2017, record the entry in Tally on same date as shown below.

HDFC Bank A/c Dr

To Interest

You should enter the bank clearing date as per the bank statement for the above recorded transactions as well (Bank charges, Pradeep & Interest).

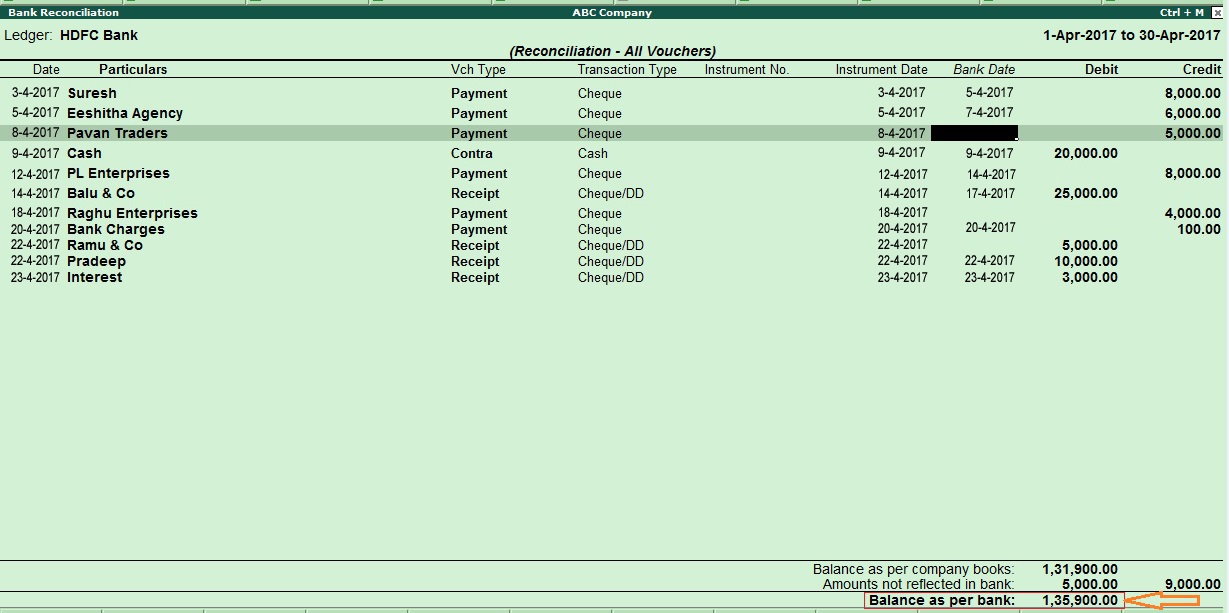

Now, you have entered the bank clearing date in bank date filed for all the above transactions of the reconcile period.

Issued cheques to Pavan Traders and Raghu Enterprises but not yet presented for payment during the April 2017.

Received cheque from Ramu & Co and the same has been deposited in bank on 28.04.2017 but payment not collected by the bank during the April 2017.

Now, the balance as per the bank as on 30.04.2017 is Rs.1,35,900 is matching with pass-book balance (Bank statement).

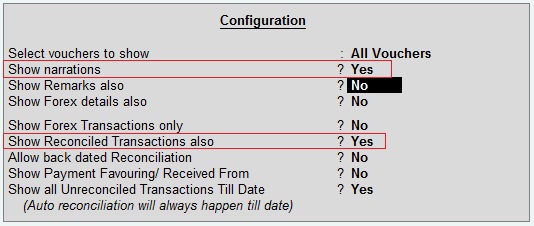

How to see reconciled transactions and narrations in Tally ERP9

Path:Gateway of Tally -> Banking -> Bank Reconciliation

Select bank ledger (HDFC Bank)

Click on F12 Configure

Enable below options

Show narrations: Yes

Show reconciled transactions also: Yes

Related Topics

How to Activate GST in Tally ERP9

TDS on Professional Charges in Tally ERP9

GST Classifications in Tally ERP9

Related Pages

- How to Post TDS Receivable Entry in Tally ERP9

- List of Shortcut Keys in Tally ERP9

- Enable TDS in Tally ERP9

- GST Classifications in Tally ERP9

- Import of Goods under GST in Tally ERP9

- Sales to Unregistered Dealer in Tally ERP9

- Input Service Distributor under GST in Tally ERP9

- How to Activate GST in Tally ERP9

- How to Enable TDS in Tally ERP9

- TDS on Professional Charges in Tally ERP9

- GSTR-1 Report in Tally ERP9

- GSTR-2 Report in Tally ERP9

- GSTR-3B Report in Tally ERP9

- What is Tally ERP9

- How to Create Company in Tally ERP9

- List of Ledgers and Groups in Tally ERP9

- How to Create, Display, Alter and Delete Ledgers in Tally ERP9

- How to Create, Display, Alter and Delete Group in Tally ERP9

- Sales Voucher in Tally ERP9

- Purchase Voucher in Tally ERP9