Journal Voucher in Tally ERP9

You will not record all kind of transactions by using the journal voucher, in this voucher you can record adjustment entries, provisional entries and tax adjustment entries except cash and bank transactions.

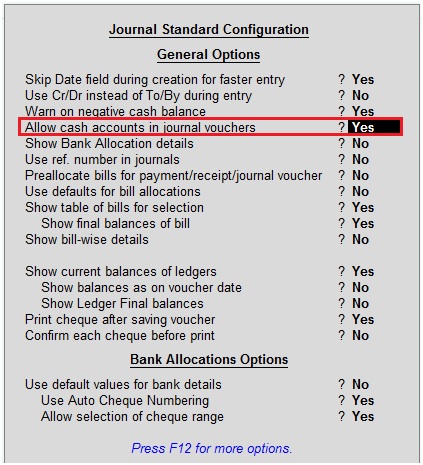

However, by activating the below option you can able to post cash or bank transactions in Tally erp9 by using the journal voucher.

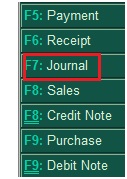

Along with Journal voucher type, Tally has provided different voucher types like payment voucher (F5), receipt voucher (F6), sales voucher (F8), purchase voucher (F9) and contra voucher (F4).

You can post many accounting entries by using journal voucher in Tally erp9.

The following transactions are examples for journal voucher.

Outstanding expenses entries

Telephone expenses a/c Dr 600

To Telephone exp payable a/c 600

Stationary expenses a/c Dr 500

To Vendor 500

Prepaid expenses entry

Insurance a/c Dr 6000

Prepaid insurance a/c Dr 6000

To Vendor a/c 12000

Insurance premium paid for the period of July 2017 to June 2018 so, you have to split for current year portion. Example insurance paid for 12 months is Rs.12000 and portion of the current year is Rs.6000.

Accrued income entry

Accrued Rent a/c 6000

To Rent a/c 6000

Purchase of fixed asset on credit entry

Furniture a/c Dr 10000

To Vendor a/c 10000

Depreciation entry

Depreciation a/c Dr 8000

To Furniture a/c 5000

To Plant & Machinery a/c 3000

Tax provision entry

Provision for income tax Dr 7000

To TDS 5000

To Advance tax 2000

Salary provision entry

Salaries a/c Dr 12000

Salaries payable a/c 12000

How to record entries in journal voucher in Tally ERP9

Path: Gateway of Tally -> Accounting vouchers -> Journal F7

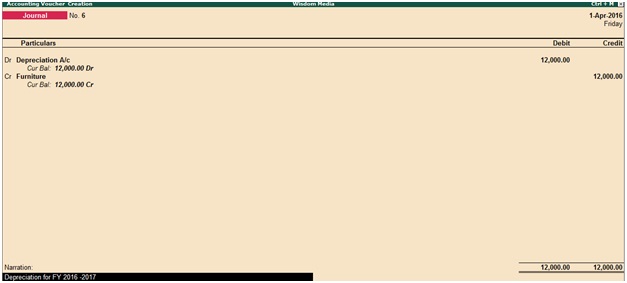

Example for journal entry

Depreciation A/c Dr 12000

To Furniture 12000

Press enter to save the screen

Related Topics

Related Pages

- How to Post TDS Receivable Entry in Tally ERP9

- List of Shortcut Keys in Tally ERP9

- Enable TDS in Tally ERP9

- GST Classifications in Tally ERP9

- Import of Goods under GST in Tally ERP9

- Sales to Unregistered Dealer in Tally ERP9

- Input Service Distributor under GST in Tally ERP9

- How to Activate GST in Tally ERP9

- How to Enable TDS in Tally ERP9

- TDS on Professional Charges in Tally ERP9

- GSTR-1 Report in Tally ERP9

- GSTR-2 Report in Tally ERP9

- GSTR-3B Report in Tally ERP9

- What is Tally ERP9

- How to Create Company in Tally ERP9

- List of Ledgers and Groups in Tally ERP9

- How to Create, Display, Alter and Delete Ledgers in Tally ERP9

- How to Create, Display, Alter and Delete Group in Tally ERP9

- Sales Voucher in Tally ERP9

- Purchase Voucher in Tally ERP9