Export Sales under GST in Tally ERP9

You can easily record the export of goods by using a sales voucher in Tally ERP9.

Taxes will be applicable based on the type of export.

Taxable export: Integrated tax will attract on export of goods, and you need to select export taxable as a nature of transaction while creating of sales ledger.

Exempt export: No Tax will be applicable on exempt export, and you need to select export

exempt as a nature of transaction while creating sales ledger.

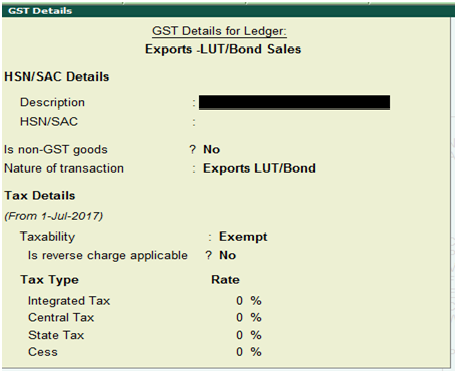

Export under LUT/bond: While creation of a sales ledger, you need to select Exports LUT/Bond as a nature of transaction for exports under LUT/Bond.

Export LUT/Bond is applicable when you have signed up a letter of undertaking with the department for the export of goods without payment of duty.

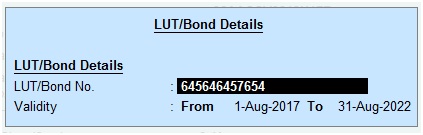

Also, in the company GST details screen, enable the option provide LUT/Bond details: Yes and you have to enter the details in LUT/Bond details screen.

Path: Gateway of Tally -> F11 Features -> Statutory and Taxation

You have to enable the following options in Statutory and Taxation features.

Enable Goods and service tax (GST): Yes

Set/alter GST details Yes

Provide LUT/Bond details: Yes

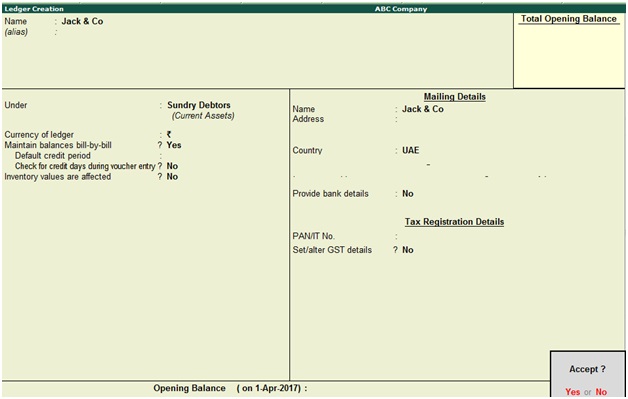

Ledgers Creation

Path: Gateway of Tally -> Accounts info -> Ledgers -> Create

Name: Jack & Co

Under: Sundry Debtors

Country: UAE

Press enter to save the screen

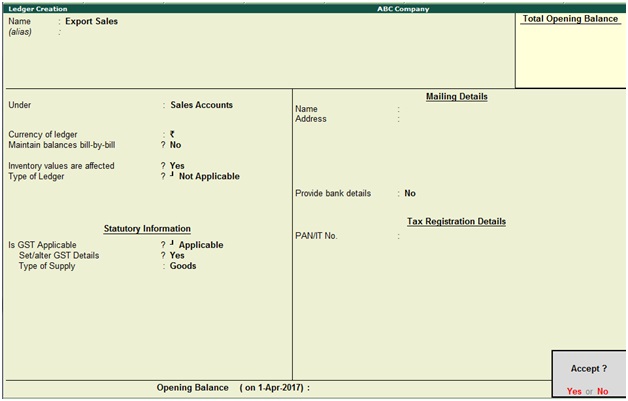

Ledger Name: Export Sales

Under: Sales Accounts

Is GST Applicable: Applicable

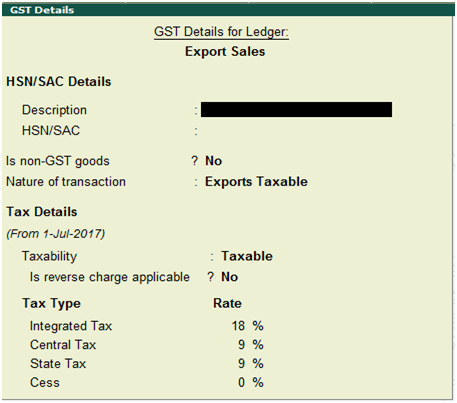

Set/alter GST details: Yes, once enable this option then the below GST details screen will appear.

Press enter to save the screen

Nature of transaction: Exports Taxable

Taxability: Taxable

Integrated Tax: 18%

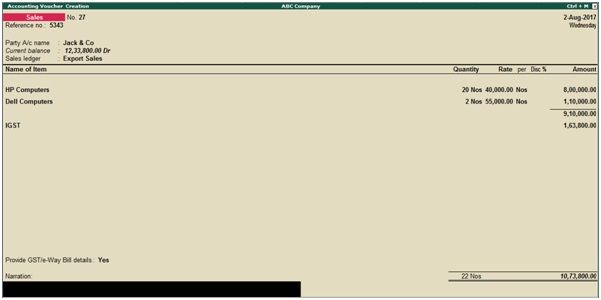

Record Export Sales in Tally ERP9

Path: Gateway of Tally -> Accounting Vouchers -> F8 Sales

Party A/c name: Select party a/c name

Select the sales ledger. (You can create separate sales ledgers for export sales taxable, export sales

exempt and export sales under LUT/Bond)

Select integrated tax ledger

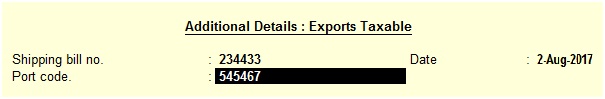

Provide GST details: Yes, once enable this option then the below screen will appear

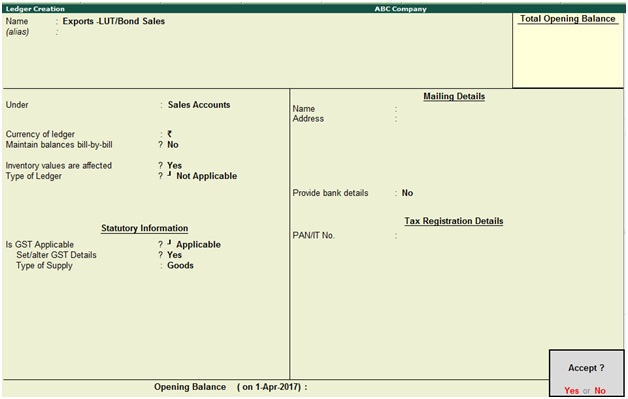

Exports -LUT/Bond Sales Ledger Creation

Path: Gateway of Tally -> Accounts info -> Ledgers -> Create

Name: Exports-LUT/Bond Sales

Under: Sales Accounts

Is GST Applicable: Applicable

Set/alter GST details: Yes, once enable this option then the below GST details screen will appear.

Press enter to save the screen

Nature of transaction: Exports LUT/Bond

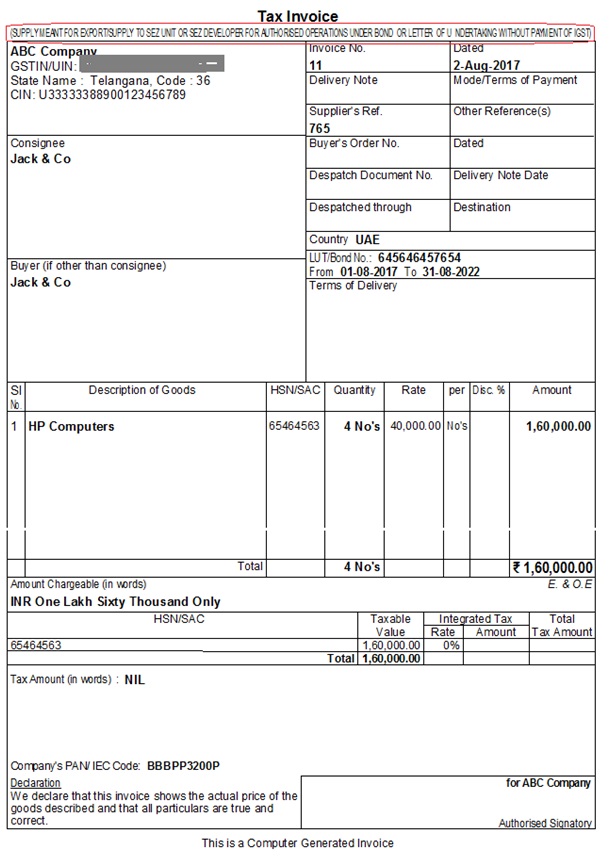

How to record exports under LUT/Bond sales

Path: Gateway of Tally -> Accounting Vouchers -> F8 Sales

Party A/c name: Enter party a/c name

Select the sales ledger

Provide GST details: Yes

Press enter to save the screen

How to print invoice in Tally ERP9

During the sales voucher screen press AlT+P to print invoice.

Related Topics

Adjustments Against Tax Credit under GST in Tally ERP9

Export Data from Tally ERP9 to Excel or PDF

Input Service Distributor under GST in Tally ERP9

Related Pages

- How to Post TDS Receivable Entry in Tally ERP9

- List of Shortcut Keys in Tally ERP9

- Enable TDS in Tally ERP9

- GST Classifications in Tally ERP9

- Import of Goods under GST in Tally ERP9

- Sales to Unregistered Dealer in Tally ERP9

- Input Service Distributor under GST in Tally ERP9

- How to Activate GST in Tally ERP9

- How to Enable TDS in Tally ERP9

- TDS on Professional Charges in Tally ERP9

- GSTR-1 Report in Tally ERP9

- GSTR-2 Report in Tally ERP9

- GSTR-3B Report in Tally ERP9

- What is Tally ERP9

- How to Create Company in Tally ERP9

- List of Ledgers and Groups in Tally ERP9

- How to Create, Display, Alter and Delete Ledgers in Tally ERP9

- How to Create, Display, Alter and Delete Group in Tally ERP9

- Sales Voucher in Tally ERP9

- Purchase Voucher in Tally ERP9