Advance Receipts against GST Sales in Tally ERP9

Advance receipts if your company turnover is less than Rs.1.5 Crores

If your company turnover in the previous financial year was less than 1.5 crores then you need not to pay tax on advance receipts against supply of goods.

Advance receipts if your company turnover is more than Rs.1.5 Crores

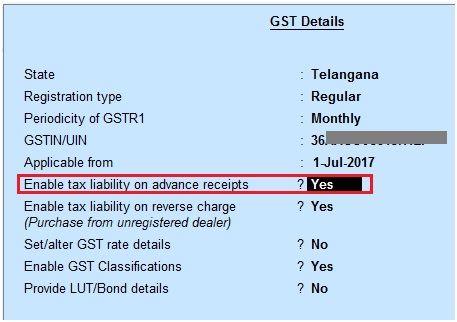

If the turnover of your company is more than Rs.1.5 crores then you have to enable the option – Enable tax liability on advance receipts to Yes in the company GST details screen, to calculate the tax liability on advance receipts.

You need to record advance received from customer against supply of goods or services in a receipt voucher.

Example 1: Advance received and total order completed in same month.

Advance receipt -> Raise tax liability -> Outward supply (adjusting advance) -> reverse the tax liability of advance amount ->File the returns

Example 2: Advance received in current month and order completed in subsequent month.

Advance receipt -> Raise tax liability -> File returns -> Outward supply in next month (adjusting advance) ->reverse the tax liability of advance amount ->File the returns

How to enable tax liability on advance receipts

Path: Gateway of Tally -> F11 Features -> Statutory & Taxation

Enable tax liability on advance receipts: Yes

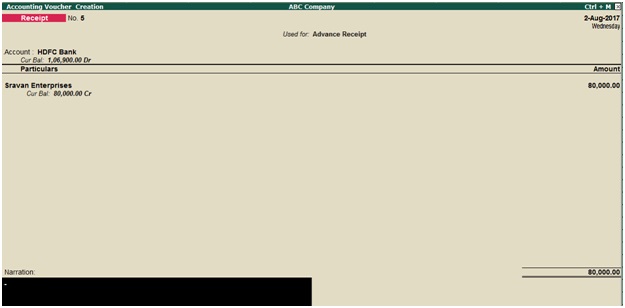

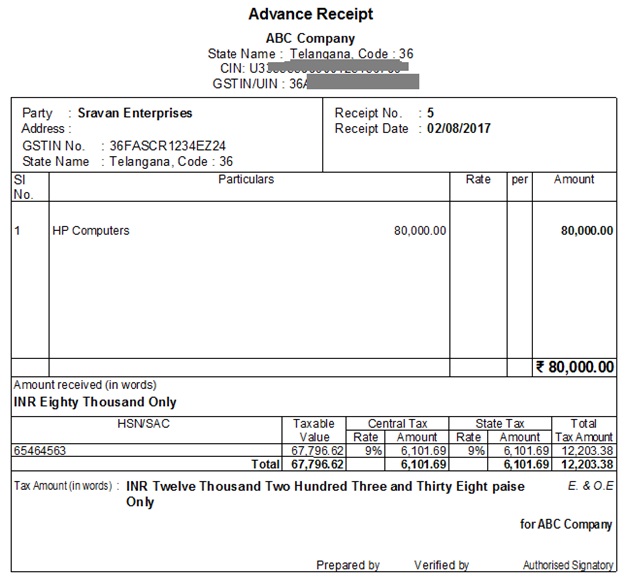

Record advance received from customer transaction in Tally.ERP9

Path: Gateway of Tally -> Accounting Vouchers -> F6 Receipt

Click on Advance receipt V for advance receipt

Account: Select the bank

Select party ledger

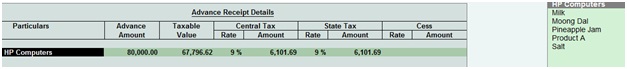

In the above advance receipt details screen under particulars you need to select stock item from the list of stock items, against which stock item you have received advance amount.

Enter advance amount, which is inclusive of GST

Select the type of reference as Advance

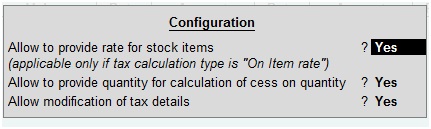

During the advance receipt details screen click on L Show ledgers and click on F12 Configure and enable the below options.

Allow to provide rate of stock items: Yes, to enter or modify the slab rate of the stock item.

Allow to provide quantity for calculation of cess on quantity: Yes, to enter the cess rate

Allow modification of tax details: Yes, to override the GST and cess rates during the voucher.

Press enter to save the screen

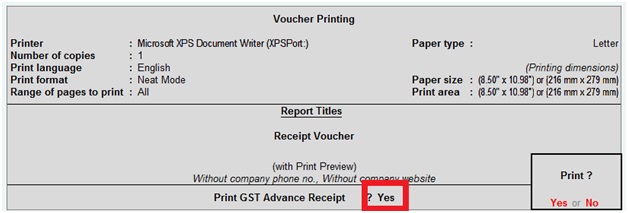

During the advance receipt voucher press Alt+P to print advance receipt.

Print GST advance receipt: Yes

Press Enter

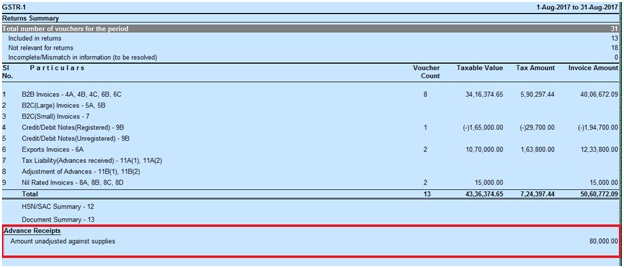

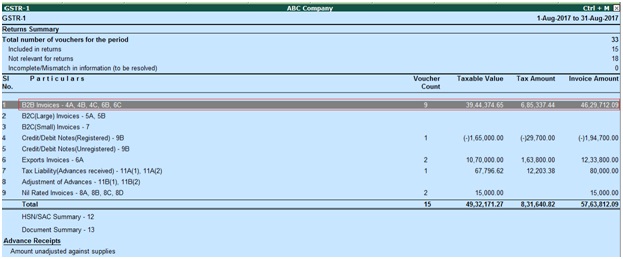

Check GSTR1 Report

Path: Gateway of Tally -> Display -> Statutory Reports -> GST -> GSTR1

Select the period, for which period you want to view GSTR1

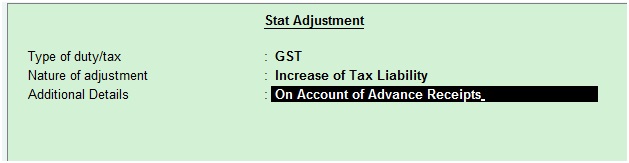

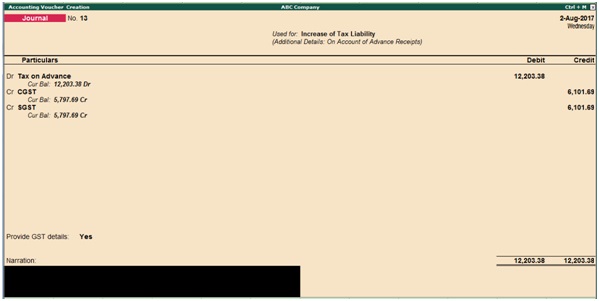

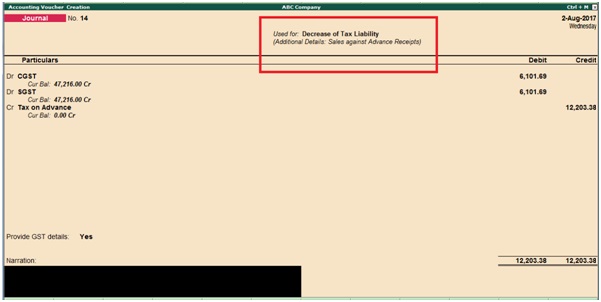

Record a voucher to raise the tax liability

Path: Gateway of Tally -> Accounting vouchers -> F7 Journal

Click on Stat Adjustment

Select the options as shown in below screenshot

Debit the Tax on advance ledger

Credit the CGST and SGST ledgers

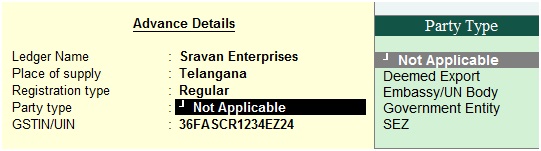

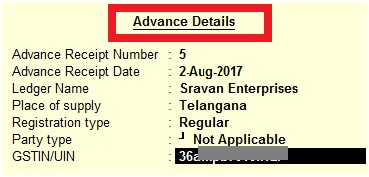

Provide GST details: Yes, once enable this option then the below screen will appear.

Press enter to save the screen

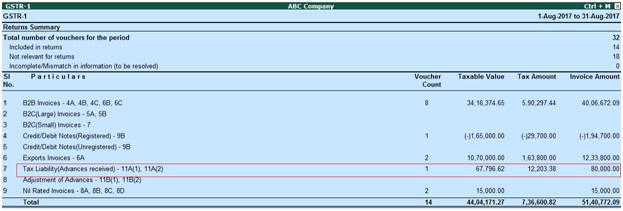

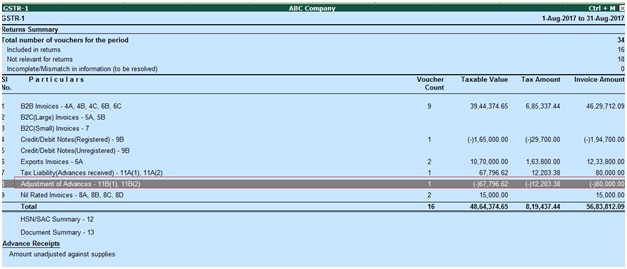

Check the impact in GSTR-1 Report

Path: Gateway of Tally -> Display -> Statutory Reports -> GST -> GSTR-1

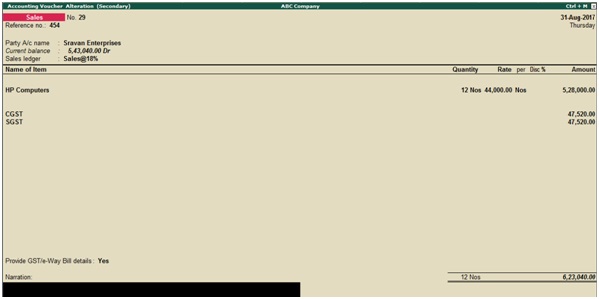

Record sales invoice and link advance received amount against invoice

Path: Gateway of Tally -> Accounting Vouchers -> F8 Sales

Reference no: Enter invoice number

Date: Enter date

Party a/c name: Enter party name

Sales ledger: Select sales ledger

Enter name of item, enter quantity and price of each

Select GST tax ledgers

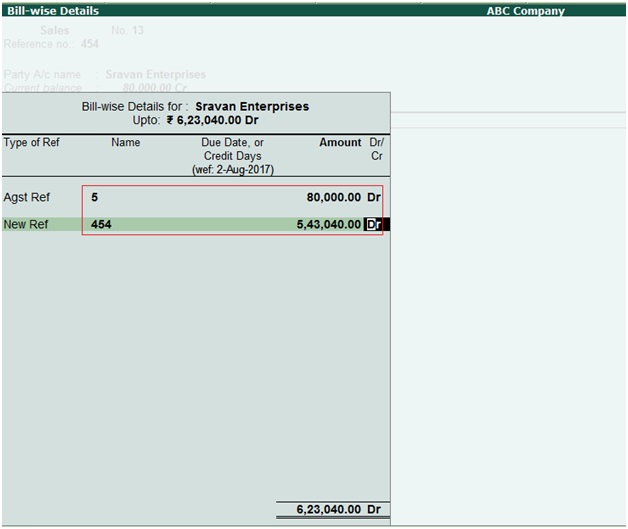

In bill wise details screen you need to adjust advance received amount against sales invoice like as shown above.

Press enter to save the screen

Check GSTR1 report

Click on B2B Invoices 4A, 4B, 4C, 6B, 6C

Reverse the tax liability on advance receipt

Path: Gateway of Tally -> Accounting Vouchers -> F7 Journal

Provide GST details: Yes, once enable this option then the below screen will appear.

Check the GSTR-1 report and observe the adjustment of advances 11B (1), 11B (2)

Path: Gateway of Tally -> Display -> Statutory Reports -> GST -> GSTR-1

Related Topics

Sales to Unregistered Dealer in Tally ERP9

Export Sales under GST in Tally ERP9

Recording Sales of Composite Supply under GST in Tally ERP9

Related Pages

- How to Post TDS Receivable Entry in Tally ERP9

- List of Shortcut Keys in Tally ERP9

- Enable TDS in Tally ERP9

- GST Classifications in Tally ERP9

- Import of Goods under GST in Tally ERP9

- Sales to Unregistered Dealer in Tally ERP9

- Input Service Distributor under GST in Tally ERP9

- How to Activate GST in Tally ERP9

- How to Enable TDS in Tally ERP9

- TDS on Professional Charges in Tally ERP9

- GSTR-1 Report in Tally ERP9

- GSTR-2 Report in Tally ERP9

- GSTR-3B Report in Tally ERP9

- What is Tally ERP9

- How to Create Company in Tally ERP9

- List of Ledgers and Groups in Tally ERP9

- How to Create, Display, Alter and Delete Ledgers in Tally ERP9

- How to Create, Display, Alter and Delete Group in Tally ERP9

- Sales Voucher in Tally ERP9

- Purchase Voucher in Tally ERP9