Basics of Employees State Insurance

Employees who are earning INR 21,000 per month or less they are eligible under ESI Act 1948.

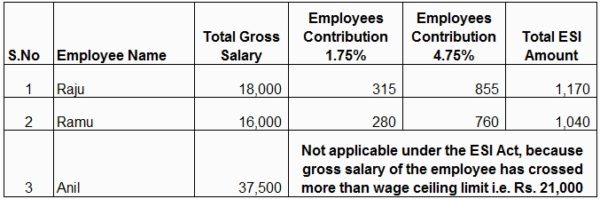

ESI employer contribution is 4.75% and employee contribution is 1.75% and the total percentage is 6.50%.

The wage ceiling under ESIC Act 1948 has been increased from INR 15,000 to INR 21,000 and this change will applicable from 1st January 2017.

Employees who are registered under the ESI scheme, they all are permit for medical treatment for themselves and their dependants.

The last wage ceiling hike was during the financial year 2010 – 2011 ESIC has been increased wage ceiling from 10,000 to 15,000 with effective from 1st May 2010

ESI Calculation

You have to pay ESI before the 21st of the following month, example, due date for ESI payable for the month of April 2017 is before 21st of May 2017.

ESI related accounting entries

Salaries A/c Dr

To ESI employees contribution A/c

To PF employees contribution A/c

To Professional Tax A/c

To TDS A/c

To Salaries Payable A/c

ESI Payment entry

ESI employees contribution A/c (1.75%) Dr

ESI Employer contribution A/c (4.75%) Dr

To Bank A/c

Related Topics

Basics of Employee Provident Fund

Related Pages

- 6 Reasons Why You Have Not Received Your Income Tax Refund Yet

- TDS on Rent Section 194I

- GST Accounting Entries for Sales and Purchases

- How to Make TDS Payment Online?

- Journal Entries For TDS

- Claiming of Tuition Fees Under Section 80C

- TCS Rates Chart

- TDS Rate Chart for Financial Year 2018-2019

- Income Tax Slab Rates FY 2018-2019

- What is GST?

- GST

- GST Registration

- GST Invoice

- GST Return

- Income Tax Slab Rates FY 2017-2018

- Professional Tax

- TDS Rate Chart for FY 2017-2018

- Interest on Late Payment of TDS

- TDS Refund

- Gratuity Calculation