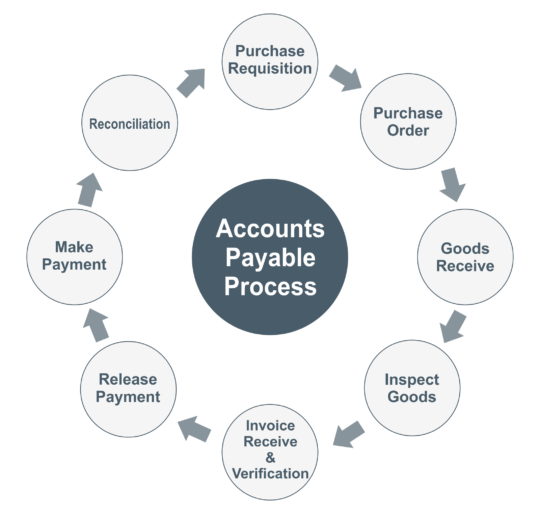

Accounts Payable Process

Companies owed money to their supplier for goods and services purchased on credit. The payable amount appears in the company’s balance sheet as a current liability under sundry creditors.

1. Purchase Requisition

It is a request to procure the goods, based on requirement and considering delivery time frame, material store room person or purchase department can issue purchase requisition.

2. Purchase order

It is a document issued by the purchaser to the supplier and purchase order indicates a PO number, PO date, company name (Buyer), vendor name (Supplier), the person name and contact number from buyer side, description of the items being purchased, quantity, unit price of each, shipping method, ship to address, delivery time frame, payment terms and other information.

3. Goods Receive

The supplier should supply goods based on the terms and conditions mentioned in order and buyer need to check all goods have been received or not as per the purchase order.

4. Inspect Goods

It is an important activity after receiving of goods from the supplier, before accepting them into your stock, the buyer has to check the condition of goods, quantity and quality and who is receiving goods from the buyer side should sign on the delivery documents provided by the supplier.

5. Invoice Receive & Verification

Invoice verification is a process which confirms that invoice has been received and need to record in accounting system and needs to compare seller invoice with the purchase order like, quantity, price of each item, and total order value before making payment to vendor/supplier.

Accounting Entry

Purchase A/c Dr 1,00,000

Input CGST A/c @2.5% Dr 2,500

Input SGST A/c@2.5% Dr 2,500

To Vendor/Supplier A/c Dr 1,05,000

6. Release Payment

You should get approval from the superior to release the payment, based on payment terms between both parties, the buyer should release the payment on or before the due date.

7. Make Payment

Once you got approval from your superior then you have to write check on your vendor name or transfer the funds through NEFT/RTGS.

Example: Payment terms 30 days from the date of invoice.

Assume, Invoice date on 01.09.2016, payment terms are from the date of invoice 30 days and the payment due date is 30.09.2016.

Accounting Entry

Vendor/Supplier A/c Dr 1,05,000

To Bank Account 1,05,000

8. Reconciliation

You have to do the vendor or customer wise reconciliation if the ledger balances are not matching between buyer and supplier books of accounts.

Example

X has to pay 50,000 towards professional charges to Y, the ledger balance should match between both books of accounts.

In X books of accounts, payable amount to Y should be Rs.50,000/- and also in Y books of accounts, the receivable amount from X should be Rs.50,000. If the ledger balances are not matching in both books of accounts, and then you should take the transactions statement for the particular period from both books of accounts and need to verify each transaction wise is there any not recorded transactions.

If you forgot to include TDS line item while recording the transaction, then balance will not match in both books of accounts this is one of the reasons.

Entry in Service Receiver Books

Professional charges paid Dr 50,000

To TDS on professional charges 5,000

To Y Account 45,000

Payment Entry

Y Account Dr 45,000

To Bank A/c 45,000

Entry in Service Provider Books

X Account Dr 50,000

To Professional charges received 50,000

Bank A/c Dr 45,000

TDS receivable Dr 5,000

To X Account 50,000

Related Topics

Interest on Late Payment of TDS

Related Pages

- Fixed Asset Entries

- Payroll Journal Entries

- Accrued Expenses

- Prepaid Income

- Accounting Basics

- Debits and Credits

- Chart of Accounts

- Bookkeeping

- Petty Cash

- Bank Reconciliation

- Accounts Receivable Process

- Prepaid Expenses

- Discount Allowed and Discount Received

- Journal Entries

- Adjusting Entries

- Depreciation

- Current Liabilities and Current Assets