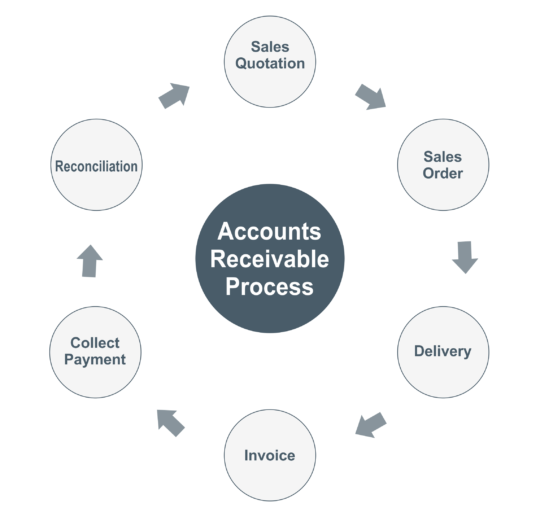

Accounts Receivable Process

Accounts receivable is the money that an organization has a right to collect the due amount from their customers who have purchased goods or services on credit.

Accounts receivables are considered as current assets on the company’s balance sheet.

Example

X company sold $1000 worth of goods to a customer and the payment terms are from the date of invoice 30 days.

Receivable Process

Sales Quotation

Quotation is a document that supplier provides to a customer with the details of material, price of each, payment terms and delivery time frame.

Sales order

The sales order is a document used for confirmation of sale, the order is received from the customer for goods to be supplied. Sales order indicates date of quotation, price of each unit, delivery time frame, shift to address and payment terms.

Delivery

As per terms mentioned in the order the supplier should dispatch the material on time along with the invoice & delivery challan. From the customer side material receiving person should put the company stamp, sign and contact number on the delivery challan for records and reference purpose.

Once the material received from the supplier, the buyer should verify the product description, quantity and quality of goods. In case of any damaged goods received, then the buyer should inform to the supplier.

Invoice

An invoice is a document that contains list goods and services that have been supplied to the customer, and it shows how much money you owe from the customer.

You have to provide invoice and signed delivery challan to the customer and the same invoice you have to record in your accounting system.

Accounting entry in seller books of accounts

Customer A/c Dr

To Sales @5%

To Output SGST@2.5%

To Output CGST@2.5%

Accounting entry in buyer books of accounts

Purchase A/c Dr

Input CGST@2.5% Dr

Input SGST@2.5% Dr

To Vendor A/c

Payment from customer

The supplier has a right to collect the money from their customers outstanding invoices, who have been purchased goods or services on credit.

As per the terms mentioned in the order, the buyer should make the payment to the seller on or before the due date.

Sometimes buyer should deduct TDS (in case of services), so while recording a payment transaction seller should cross check with an invoice total amount.

Accounting entry in supplier books of accounts

Bank A/c Dr

To Customer A/c

Accounting entry in buyer books of accounts

Vendor A/c Dr

To Bank A/c

Reconciliation

You have to do the customer or vendor wise reconciliation if the ledger balances are not matching between supplier and buyer books of accounts.

Example

X company (seller) sold $1000 worth of goods to Y (buyer), while finalization of accounts in X books of accounts receivable amount from Y should show $1000 and in Y books of accounts payable amount to X should show $1000.

In seller books of accounts, buyer name will appear on company’s balance sheet under sundry debtors.

In buyer books of accounts, seller name will appear on company’s balance sheet under sundry creditors.

Related Topics

Income Tax Slab Rates FY 2018-2019

Related Pages

- Fixed Asset Entries

- Payroll Journal Entries

- Accrued Expenses

- Prepaid Income

- Accounting Basics

- Debits and Credits

- Chart of Accounts

- Bookkeeping

- Petty Cash

- Bank Reconciliation

- Accounts Payable Process

- Prepaid Expenses

- Discount Allowed and Discount Received

- Journal Entries

- Adjusting Entries

- Depreciation

- Current Liabilities and Current Assets