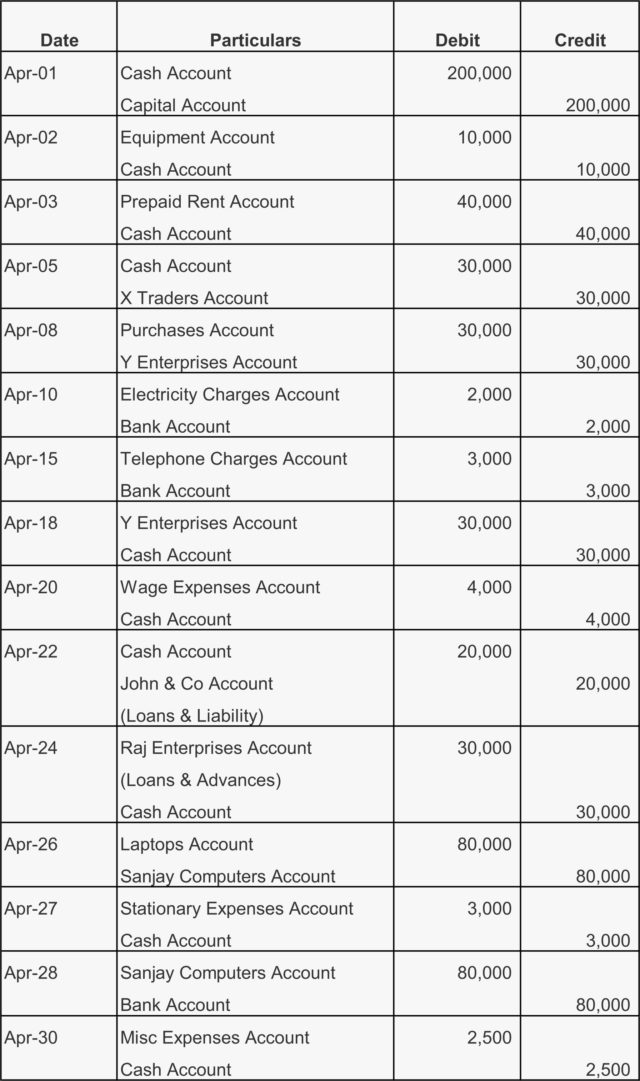

Journal Entries

Analyzing all business transactions and recording them as journal entries is the first step that shows account name, amount and the accounts are recorded debit side or credit side in accounting.

Example

The following example illustrates how to record journal entries in company’s books of accounts.

Transactions

Apr 1, started a business with Rs.200000 of capital

Apr 2 paid cash of Rs.10000 towards purchase of equipment

Apr 3, an advance rent amount paid of Rs.40000

Apr 5, provided services to X traders and received amount of Rs.30000

Apr 8, purchased Rs.30000 worth of goods from Y Enterprises

Apr 10, issued a cheque for payment of electricity charges of Rs.2000

Apr 15, issued a cheque for payment of telephone charges of Rs.3000

Apr 18, paid amount to Y Enterprises towards goods purchased on April 8

Apr 20, paid wages to its employees of Rs.4000

Apr 22, received an advance payment from John & Co of Rs.20000

Apr 24, advance paid to Raj Enterprises of Rs.30000

Apr 26, purchased 2 Laptops each@ Rs.40000 from Sanjay computers

Apr 27, cash paid towards stationary expenses of Rs.3000

Apr 28, issued a cheque to Sanjay computers towards 2 laptops purchased on April 26

Apr 30, miscellaneous expenses paid of Rs.2500

Journal entries for the above transactions

Related Topics

Related Pages

- Fixed Asset Entries

- Payroll Journal Entries

- Accrued Expenses

- Prepaid Income

- Accounting Basics

- Debits and Credits

- Chart of Accounts

- Bookkeeping

- Petty Cash

- Bank Reconciliation

- Accounts Payable Process

- Accounts Receivable Process

- Prepaid Expenses

- Discount Allowed and Discount Received

- Adjusting Entries

- Depreciation

- Current Liabilities and Current Assets