Creating House Rent Allowance Pay Head (Payroll) in Tally ERP9

As computed value is used if the pay head value is dependent on another pay component. You can also specify either percentage or value or combination of both.

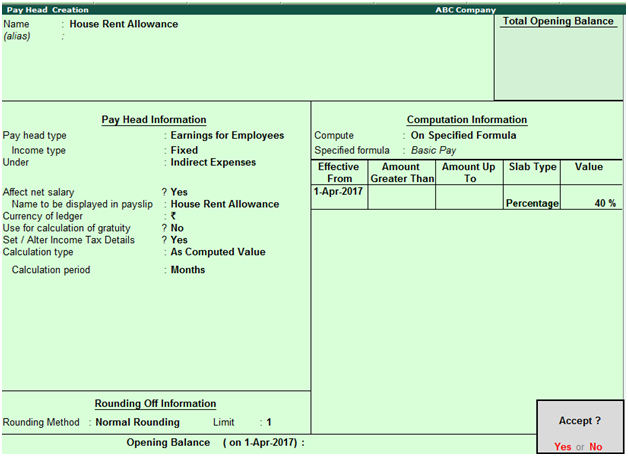

Path: Gateway of Tally -> Payroll Info -> Pay Heads -> Create

Name: House Rent Allowance

Pay head type: Select Earnings for Employees from the list of pay head types

Income type: Fixed

Under: Select Indirect Expenses from the list of groups

Affect net salary: Yes

Name to be displayed in payslip: House Rent Allowance

Currency of ledger: ₹

Use for calculation of gratuity: No

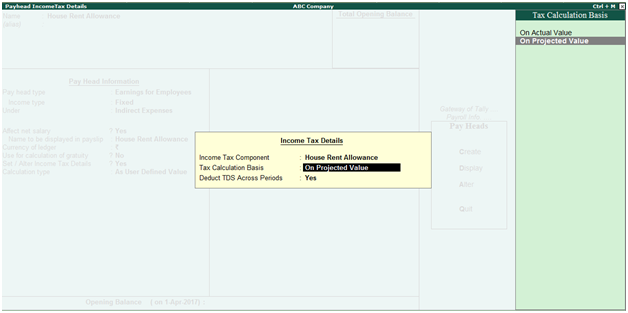

Set/alter Income Tax details: Yes, once enable this option then the below screen will appear.

Calculation type: As Computed Value

Calculation Period: Months

Rounding method: Normal rounding

Limit: 1

Computation Information

Compute: On Specified Formula and select pay head as basic pay

Effective From: 01.04.2017

Slab Type: Percentage

Value: 40%

Press enter to save the screen

Income Tax component: House Rent Allowance

Tax calculation basis: On Projected value

Deduct TDS across Periods: Yes

Press enter to save the screen

Related Pages

- Enabling Payroll in Tally ERP9

- Creating Employee Categories in Tally ERP9

- Creating Employee Groups in Tally ERP9

- Creating Attendance Type (Payroll) in Tally ERP9

- Creating (Basic Pay) Pay Head in Tally ERP9

- Creating Conveyance Allowance Pay Head (Payroll) in Tally ERP9

- Creating Other Allowance Pay Head (Payroll) in Tally ERP9

- Creating Overtime Pay Head (Payroll) in Tally ERP9

- Creating Variable Pay Head (Payroll) in Tally ERP9

- Creating Salary Advance Deduction Pay Head (Payroll) in Tally ERP9

- Creating Pay Head for Income Tax Deduction (Payroll) in Tally ERP9

- Creating Employee’s PF Deduction Pay Head (Payroll) in Tally ERP9

- Creating Employee’s ESI Deduction Pay Head (Payroll) in Tally ERP9

- Creating Professional Tax Pay Head (Payroll) in Tally ERP9

- Creating Employer’s EPS Contribution Pay Head (Payroll) in Tally ERP9

- Creating Employer’s EPF Contribution Pay Head (Payroll) in Tally ERP9