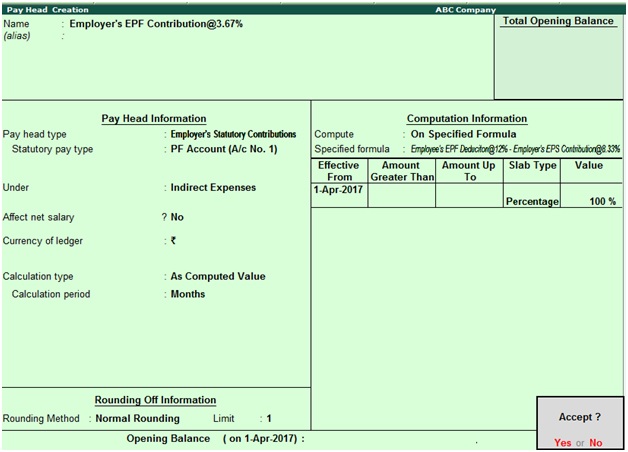

Creating Employer’s EPF Contribution Pay Head (Payroll) in Tally ERP9

You need to create employer’s EPF contribution pay head in Tally ERP9 as shown below.

Path: Gateway of Tally -> Payroll Info -> Pay Heads -> Create

Name: Employer’s EPF Contribution@3.67%

Pay head type: Select Employer’s Statutory Contributions from the list of pay head types

Statutory pay type: EPS Account (A/c No.1)

Under: Select Indirect Expense from the list of groups

Affect net salary: No

Currency of ledger: ₹

Calculation type: As Computed Value

Calculation period: Months

Rounding method: Normal Rounding

Limit: 1

Computation Information

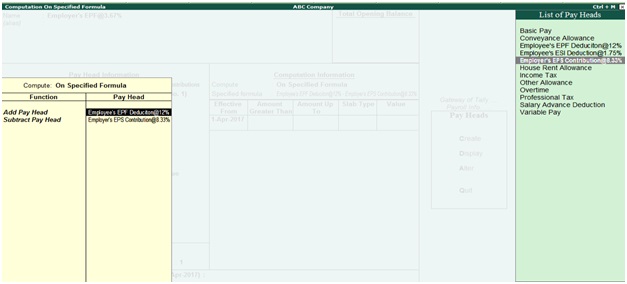

Compute: On Specified Formula

Effective from: 01.04.2017

Enter the Employer’s EPF slab type and value as shown in the below screen

Press enter to save the screen

Related Pages

- Enabling Payroll in Tally ERP9

- Creating Employee Categories in Tally ERP9

- Creating Employee Groups in Tally ERP9

- Creating Attendance Type (Payroll) in Tally ERP9

- Creating (Basic Pay) Pay Head in Tally ERP9

- Creating House Rent Allowance Pay Head (Payroll) in Tally ERP9

- Creating Conveyance Allowance Pay Head (Payroll) in Tally ERP9

- Creating Other Allowance Pay Head (Payroll) in Tally ERP9

- Creating Overtime Pay Head (Payroll) in Tally ERP9

- Creating Variable Pay Head (Payroll) in Tally ERP9

- Creating Salary Advance Deduction Pay Head (Payroll) in Tally ERP9

- Creating Pay Head for Income Tax Deduction (Payroll) in Tally ERP9

- Creating Employee’s PF Deduction Pay Head (Payroll) in Tally ERP9

- Creating Employee’s ESI Deduction Pay Head (Payroll) in Tally ERP9

- Creating Professional Tax Pay Head (Payroll) in Tally ERP9

- Creating Employer’s EPS Contribution Pay Head (Payroll) in Tally ERP9