Accounting Interview Questions and Answers

What is an Accounting?

Accounting is used for business entities and it is a systematic process of identifying, recording of financial transactions, and also it indicates the process of summarising, analysing, and presenting various financial reports of a business.

What are the different branches of accounting?

The following three are the branches of accounting.

- Financial Accounting

- Management Accounting

- Cost Accounting

What are the accounting concepts?

The following are the important accounting concepts

- Business Entity Concept

- Money Measurement Concept

- Going Concern Concept

- Cost Concept

- Matching Concept

- Accrual Concept

- Dual Aspects Concept

- Accounting Period Concept

What is accrual concept?

This is also known as the mercantile system of accounting. The expenses and revenues that have been incurred or earned during the month, but will be paid or received in the future has to be recorded in the books of accounts as per accrual base system of accounting.

Example: Telephone charges incurred for April is Rs.10,000 but the due date is 10th of the following month (May), in this case you have to make telephone charges provision entry at April month end.

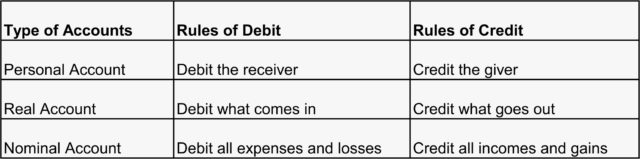

What are the accounting rules of debit and credit?

What is debit and credit in accounting?

A debit indicates that either increases of asset or expense account or decrease a liability.

A credit indicates that either increase of liability or decrease of expense account or asset.

What is bookkeeping?

Bookkeeping is recording of daily business financial transactions up to date and it is part of the process of accounting in business. Transactions include the recording of sales, purchase, payment from customers, payment to suppliers, staff salaries, journal entries and other adjustment entries and bookkeeper is the responsible person to record day to day transactions.

What are prepaid expenses?

Prepaid expenses are future expenses that have been paid in advance for goods and services to be received. Prepaid expenses are shown on the balance sheet under current asset side.

Accounting entries

Prepaid Insurance Account Dr

To Bank Account

Insurance Expenses Account Dr

To Prepaid Insurance Account

What are accrued expenses?

Expenses are incurred but not yet been paid called as accrued expenses such as wages, salaries, telephone expenses etc.

Accounting entries

Telephone Expenses A/c Dr

Telephone Expenses Payable A/c

Salary A/c Dr

To Salary Payable A/c

What is prepaid income?

Prepaid income also known as unearned income, which is received in advance before supply of goods or services. Prepaid income or advance received is treated as a liability.

What are the profit and loss account items and name out few?

Salaries

Printing and stationary

Rent expenses

Advertisement expenses

Travelling expenses

Commission

Discount received and allowed

Depreciation

Interest

Rates and taxes

What is the adjustment entries made while preparing of final accounts?

Prepaid expense

Accrued income

Depreciation

Drawings

Bad debts

Provision for doubtful debts

Outstanding expenses

Closing stock

Provision for tax

Interest on capital

What is the provision entry for telephone expense?

Telephone expense A/c Dr

To Telephone charges payable A/c

What is the entry for bad debts?

Bad debt expense A/c

To Receivable A/c